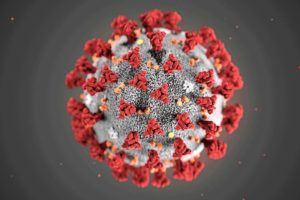

Coronavirus (COVID-19): Important Information about Social Security Services

Reading Time: 1 MinuteLast Updated: February 21, 2023

All local Social Security offices will be closed to the public for in-person service starting Tuesday, March 17, 2020. This decision protects the population we serve—older Americans and people with underlying medical conditions—and our employees during the Coronavirus (COVID-19) pandemic. However, we are still able to provide critical services.

All local Social Security offices will be closed to the public for in-person service starting Tuesday, March 17, 2020. This decision protects the population we serve—older Americans and people with underlying medical conditions—and our employees during the Coronavirus (COVID-19) pandemic. However, we are still able to provide critical services.

Please read our press release to learn more, including how to get help from the Social Security Administration by phone and online. You can also visit our website to learn more and stay up to date.

Please share this message with your friends and loved ones.

Did you find this Information helpful?

Tags: COVID-19, social security, Social Security benefits

See CommentsAbout the Author

Comments

Comments are closed.

Roberta D.

I am trying to find out why my child did not receive a stimulus check, I have tried to call but can’t reach anyone. I need to talk to someone about this…

Ann C.

Hi, Roberta. Please visit the Internal Revenue Service’s website here for all your Economic Impact Payment-related questions. If you are unable to find the answer, call the IRS hotline at 1-800-919-9835. Thanks!

Roxanne C.

we are Social Security recipients. my husband has received his $1200 stimulus in May and I have not received mine yet. I went to “get my payment” online and it told me that I am not eligible. I do not know what to do. My mother 87yrs, already has received hers. I am 66yrs old. I need advise. Thank you.

Ann C.

Hi, Roxanne. We are sorry to hear about your situation. Please visit the Internal Revenue Service’s website here for all your Economic Income Payment-related questions. If you are unable to find the answer, call the IRS hotline at 1-800-919-9835. Thanks!

kelly

I came on the Internet i saw great testimony about DR Voke on how he was able to cure someone from HERPES, and any disease this person said great things about this man, and advice we contact him for any problem that DR Voke can be of help, well i decided to give him a try, he requested for my information which i sent to him, and he told me he was going to prepare for me a healing portion, which he wanted me to take for days, and after which i should go back to the hospital for check up, well after taking all the treatment sent to me by DR Voke i went back to the Hospital for check up, and now i have been confirmed HERPES Negative, friends you can reach Dr voke on any treatment for any Disease, reach him on _________________________________doctorvoke@gmail. com

TIMOTHY L.

Not very helpful. I have tried this and numerous other SS websites but cannot find a link to check on the status of my economic impact payment (stimulus check). I know I qualify and the gov. has all my banking info which is current (receive SS payments and tax refunds to bank account with no problems). When I did find a stimulus check website to check on status I was unable to use it to check on the status of my check.

Tried to contact one senator and my congressional representative online but that was also difficult (websites not user friendly), so I mailed letters a few days ago.

All in all, disappointed in the government websites although mySS website usually works fine for me.

Thanks for letting me respond.

Vonda V.

Hi Timothy, thank you for using our blog. Please visit the IRS Economic Impact Payments Information Center to answer your questions about eligibility, payment amounts, what to expect, when to expect it and more. If you are unable to find the answer, call the IRS hotline at 1-800-919-9835. Thanks!

Diane R.

I was hoping I’d get a first stimulas check do I make to much money$870.00 a month get a hold of me at 971-732-4439

Ramon S.

How does unemployment benefits effect Social Security benefits. I am almost 65 and am furloughed from my job until 31August. I don’t think we will be called back and I am thinking of filling for my social security benefits before I turn 66 and 2 months. Thank you.

Vonda V.

Hi Ramon, thank you for your question. Unemployment benefits do not affect or reduce Social Security retirement and disability benefits. State unemployment compensation payments are not wages because they are paid due to unemployment rather than employment. However, income from Social Security may reduce your unemployment compensation. Contact your state unemployment office for information on how your state applies the reduction.

Miranda

What is your fax number

Bertilda A.

Dear Madam!/Sir, I got already my green card but still I do not receive my social security. I submitted already my application last May 6, 2020 at the office of Pensacola Florida. I’ve been waiting for my ssn because me and my husband will be filling a 2019 tax return. They need my ssn and they will not file our income tax if I don’t have ssn. Also we cannot open a bank account in navy federal credit union without my ssn. Pls. Give an action on this matter. Thanks

Vonda V.

Hi Bertilda, thanks for using our blog. Please check in with your local Social Security office. Look for the general inquiry telephone number at the Social Security Office Locator. The number may appear under Show Additional Office Information. Please be aware that our call wait times are longer than normal. We hope this information helps.

bianca s.

is we going to get a nother check

GLADYS I.

When are the SS offices in Miami be opened?

Jeffry S.

Our local ss office is still closed. Can I start voluntary withholding from my ss payment on-line?

Vonda V.

Hi Jeffry, thanks for using our blog. To start, stop or change your voluntary tax withholding, you’ll need a Form W-4V from the Internal Revenue Service (IRS). You can download the form or call the IRS toll-free at 1-800-829-3676 and ask for Form W-4V. Return the completed, signed form to your local Social Security office by mail. Use our Social Security Office Locator to obtain the address of your local office.