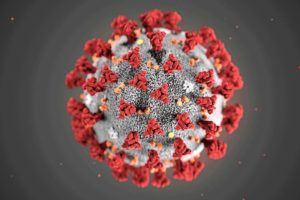

Coronavirus (COVID-19): Important Information about Social Security Services

Reading Time: 1 MinuteLast Updated: February 21, 2023

All local Social Security offices will be closed to the public for in-person service starting Tuesday, March 17, 2020. This decision protects the population we serve—older Americans and people with underlying medical conditions—and our employees during the Coronavirus (COVID-19) pandemic. However, we are still able to provide critical services.

All local Social Security offices will be closed to the public for in-person service starting Tuesday, March 17, 2020. This decision protects the population we serve—older Americans and people with underlying medical conditions—and our employees during the Coronavirus (COVID-19) pandemic. However, we are still able to provide critical services.

Please read our press release to learn more, including how to get help from the Social Security Administration by phone and online. You can also visit our website to learn more and stay up to date.

Please share this message with your friends and loved ones.

Did you find this Information helpful?

Tags: COVID-19, social security, Social Security benefits

See CommentsAbout the Author

Comments

Comments are closed.

Dawn C.

Have not gotten any stimnlis check wondering if IAM not supposed to can you help .thank you

Dawn C.

Hello can u tell me if SSI person’s will get a stimnlis check I have no dependent s IAM not married am divorced live with my sister am65 now do not have to pay or file taxes

Martin P.

are we as ameericanc here in st maarten eligibLE PLEASE HELP US WITH THID WE ARE ALL IN THIS TOGETHER

Martin P.

we are here stuck in st maarten

Natasha D.

If you get ssi and work can you get unemployment tow are do if efficient ssi

Vonda V.

Hi Natasha, thank you for your question. If you’re receiving Supplemental Security Income (SSI), unemployment insurance benefits are considered unearned income. If you, your spouse, or a child living in your household have any income other than your Supplemental Security Income (SSI) payment, including unemployment insurance benefits, you must tell us. Please note that we will not consider economic impact payments as income for SSI recipients, and the payments are excluded from resources for 12 months.

For more about reporting income, check out the online booklet, Understanding Supplemental Security Income. To report your income, you can call us at 1-800-772-1213 (TTY 1-800-325-0778) or your local Social Security office. Please look for the general inquiry telephone number at the Social Security Office Locator. The number may appear under Show Additional Office Information. Please be aware that our call wait times are longer than normal. We hope this information helps.

Judy J.

I want to have direct deposit to my bank. I now have direct express and want to change.

Richard M.

Can I collect my full social security benefits early because of the coronavirus pandemic

Vonda V.

Hi Richard, thanks for using our blog. If you’re asking about Social Security retirement benefits, you may start receiving benefits as early as age 62 or as late as age 70. Monthly benefits are reduced if you start them any time before your “full retirement age”. Your full retirement age depends on your date of birth. It may be between age 66 and 67. This could affect the amount of your benefits and when you want the benefits to start.

The Benefits Planner: Retirement provides detailed information about Social Security retirement benefits.

Amie M.

I have ssi benefits from social security they made a mistake? I NEED IT FIXED ASAP AND I HAVE BACK PAY $ I NEED ASAP I WILL BE ON THE STREET I NEED MY MONEY TO LIVE.. AND PAY RENT UTILITIES FOOD CLOTHS DO I NEED TO GO ON I HAVE NO CAR… I NEED MY MONEY NOBODY TAKES CARE OF ME.. HOW THIS PERSON CAME UP WITH THIS INFORMATION I HAVE NO IDEA… I GET 566.00 A MONTH CAN YOU LIVE ON THAT? I NEED HELP.. HELP..HELP….

Vonda V.

Hi Amie, thanks for using our blog. For your security, we do not have access to private information in this venue. We ask that members in our Blog community work with our offices with specific questions. You can call us at 1-800-772-1213 for assistance or you can contact your local Social Security office. Please look for the general inquiry telephone number at the Social Security Office Locator. The number may appear under Show Additional Office Information. Please be aware that our call wait times are longer than normal. We hope this information helps.

Elizabeth

I am trying to get my SSDI back that I had for several years as my health is going downhill. I am being told that because I am drawing unemployment since I have not been deemed disabled yet but authorities other than my doctors, that I will automatically lose my SSDI case with the judge I have. Am I suppose to give up UI and lose my house and all that I worked hard for?

Vonda V.

Hi Elizabeth, thank you for your question. Unemployment benefits do not affect or reduce Social Security retirement and disability benefits. State unemployment compensation payments are not wages because they are paid due to unemployment rather than employment.

However, if you’re applying for Supplemental Security Income (SSI) disability, unemployment insurance benefits are considered unearned income and could affect eligibility.

You can call us at 1-800-772-1213 for assistance or you can contact your local Social Security office. Please look for the general inquiry telephone number at the Social Security Office Locator. The number may appear under Show Additional Office Information. Please be aware that our call wait times are longer than normal. We hope this information helps.

Editha D.

Just wanna ask if my mom Lucia P David going to receive a stimulus check,bec everyone got there check my Mom didn’t got it Thanks,Edith Deguzman ,daughter

Vonda V.

Hi Editha, thank you for your question. Please visit the IRS Economic Impact Payments Information Center to answer your questions about eligibility, payment amounts, what to expect, when to expect it and more. If you are unable to find the answer, call the IRS hotline at 1-800-919-9835. Thanks!