See What You Can Do Online!

Reading Time: 1 MinuteLast Updated: August 19, 2021

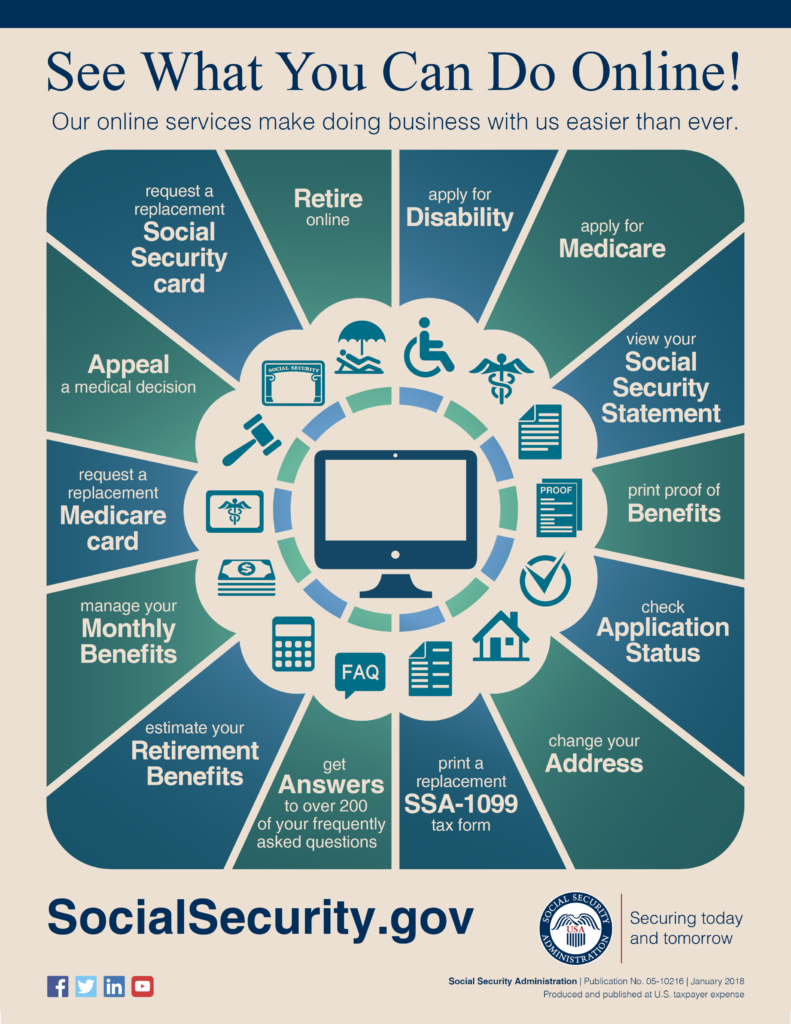

For over 80 years, Social Security has changed to meet the needs of our customers. Today, our easy, secure, and convenient-to-use online services allow you to do business with us from the comfort of your preferred location. From requesting a Social Security card to filing for retirement, our online services have got you covered. Check out our infographic, which shows what you can do online:

Did you find this Information helpful?

Tags: retirement benefits, Social Security benefits

See CommentsAbout the Author

Comments

Comments are closed.

Laurel D.

Thank you

Laurel D.

My email address has changed from lduggan@q.com to laurelduggan@comcast.net

Terrence O.

Can I change [increase] my federal income tax withheld from my monthly social security benefit ON LINE?

A.C.

Hi, Terrence. In order to have taxes withheld or make changes with your tax withholding from your Social Security benefit, you must start by printing, completing and submitting an IRS Voluntary Withholding Request Form (Form W-4V). On this form, you can choose to have 7, 10, 12, or 22 percent of your monthly benefit withheld. The Form W-4V (to withhold federal taxes from your Social Security benefits) can be returned to your local Social Security office by mail or in person. See our Benefits Planner: Withholding Income Tax From Your Social Security Benefits web page for more information. We hope this helps.

Renee R.

I turn 66, which is full retirement age on October 14. My husband has been fully retired for about 15 years. I understand that I can begin taking spousal benefit this October 2019, and delay my own benefit. When do I begin the application?

A.C.

Hi, Renee. Thank you for your question. Social Security retirement claims can be filed up to 4 months in advance. Keep in mind to qualify for spouse’s benefits, your husband must be receiving retirement or disability benefits. Also, if you qualify for Social Security benefits on your own record, we pay that amount first. But if you also qualify for a higher amount as a spouse, you’ll get a combination of benefits that equals that higher amount. Visit our Retirement Planner: Benefits For You As A Spouse for more information. We hope this helps.

Frank

Got up this morning and I can’t seem.yo log into my account.i could yesterday not today this morning

Myra

How do I get income taxes withheld form my social security check?

A.C.

Hi, Myra. Thanks for your question. In order to have taxes withheld from your Social Security benefit, you must start by printing, completing and submitting an IRS Voluntary Withholding Request Form (Form W-4V). On this form, you can choose to have 7, 10, 12, or 22 percent of your monthly benefit withheld. The Form W-4V (to withhold federal taxes from your Social Security benefits) can be returned to your local Social Security office by mail or in person. See our Benefits Planner: Withholding Income Tax From Your Social Security Benefits web page for more information.

Teri L.

Please advise how to have taxes withheld from Social Security.

A.C.

Hi, Teri. In order to have taxes withheld from your Social Security benefit, you must start by printing, completing and submitting an IRS Voluntary Withholding Request Form (Form W-4V). On this form, you can choose to have 7, 10, 12, or 22 percent of your monthly benefit withheld. The Form W-4V (to withhold federal taxes from your Social Security benefits) can be returned to your local Social Security office by mail or in person. See our Benefits Planner: Withholding Income Tax From Your Social Security Benefits web page for more information. We hope this helps.

Leslie T.

I closed the checking account associated with my direct deposit from Social Security on June 26, 2019.

When I went online to change the checking account number for direct deposit, the soonest it will allow is for my September check to be deposited.

How do I receive payments for July 2019 and August 2019?

Help please. Thank you!

A.C.

Hi, Leslie. For your security, we do not have access to private information in this venue. We ask that members in our Blog community work with our offices with specific questions. You can call us at 1-800-772-1213, Monday through Friday, between 7:00 a.m. and 7:00 p.m., for assistance. Generally, you will have a shorter wait if you call later in the day. You can also contact your local Social Security office. We hope this helps.

Raymond A.

Good Morning, I have applied for my social security and told that I might receive a phone for additional info. Maybe even outside your working hours, I want to confirm this is true? Is it possible to give me the number so I can recognize it. With recent bombardment of Robo calls I no longer answer calls that I don’t know.

A.C.

Hi, Raymond. Social Security Administration (SSA) employees occasionally contact individuals by telephone for customer-service purposes. An SSA employee may call you in limited situations, such as if you recently filed a claim or have other pending Social Security business. If a person has questions about any communication—email, letter, text or phone call—that claims to be from SSA or the OIG, please contact your local Social Security office. You may also call Social Security’s toll-free customer service number at 1-800-772-1213, 7:00 a.m. to 7:00 p.m., Monday through Friday, to verify its legitimacy (TTY number at 1-800-325-0778). Thanks.

Christine m.

Does anyone know how to get a work history. I’m applying for a early pension .