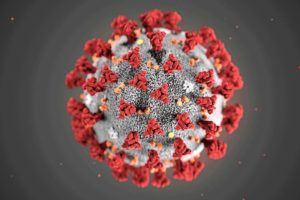

Coronavirus (COVID-19): Important Information about Social Security Services

Reading Time: 1 MinuteLast Updated: February 21, 2023

All local Social Security offices will be closed to the public for in-person service starting Tuesday, March 17, 2020. This decision protects the population we serve—older Americans and people with underlying medical conditions—and our employees during the Coronavirus (COVID-19) pandemic. However, we are still able to provide critical services.

All local Social Security offices will be closed to the public for in-person service starting Tuesday, March 17, 2020. This decision protects the population we serve—older Americans and people with underlying medical conditions—and our employees during the Coronavirus (COVID-19) pandemic. However, we are still able to provide critical services.

Please read our press release to learn more, including how to get help from the Social Security Administration by phone and online. You can also visit our website to learn more and stay up to date.

Please share this message with your friends and loved ones.

Did you find this Information helpful?

Tags: COVID-19, social security, Social Security benefits

See CommentsAbout the Author

Comments

Comments are closed.

Jonathon

Fucking Idiots

Ramesh

Good post.very interesting and informative Post …This was truly awesome. Thanks so much for this..!

https://youtu.be/AmaBNzn1-mo

Willy

Please #Stay Home guys PKV Games

The O.

Do not kill yourself Amanda until you give me your kidneys and Liver, I am going to do everything the Doctor told me was wrong when I was younger, I will start drinking, smoking, and hanging around with women of ill repute.

Juan

Hello there, I am American citizen, currently living in Taiwan. I don’t have job, low income, no kid. I am absolutely entitled to get covid-19 subsidy. I don’t have bank account and physical address in America, but I got monthly social security payment from SSA every month, they will remit money to my City Bank account in Taiwan. My question is: How can I get my subsidy for covid 19? Which department should I send my application? Thanks for the earliest reply.

Vonda V.

Hi Juan, thank you for your question. Please visit the IRS Economic Impact Payments Information Center to answer your questions about eligibility, payment amounts, what to expect, when to expect it and more. Hope this helps!

Emil &.

Both my wife and I receive direct deposit Social security But we received a check for our tax refund. My question is will our stimulus payment be direct deposit or check I’ve heard contradicting answers Do we have to do any thing? PS please ignore some of this angry hate talk everyone has cabin fever just THANK GOD YOUR ALIVE

The O.

Thank God you are alive and thank Him for not allowing Hillary to be in charge.

Email recieved today from Bank of America: Here are a few things to keep in mind:The Internal Revenue Service (IRS) is responsible for the timing, amount and distribution of these payments, and has stated that payments will be sent in waves over the course of multiple weeks into July 2020.For most of the recipients, payments will be deposited directly into the same bank account that they have most recently used to receive a tax refund or monthly Social Security payment.

Others will receive paper checks in the mail, at the address that the IRS has on file for that individual.

Direct deposits are posted for open accounts on the effective date set by the Treasury.

Emil &.

Both my wife and I receive direct deposit Social Secuity but our tax refund was mailed by check, Will this affect how we receive the stimulus payment if so what do we need to do?

Vonda V.

Hi Emil and Kathy, thank you for your question. Social Security retirement, survivors, or disability beneficiaries and Supplemental Security Income (SSI) recipients who do not have qualifying children under age 17 do not need to take any action with the IRS. You will automatically receive your $1,200 economic impact payment directly from the IRS. You should receive the automatic payments by direct deposit, Direct Express debit card, or by paper check, just as you would normally receive your Social Security benefits. Treasury expects automatic payments for Social Security beneficiaries no later than the end of April and automatic payments for SSI recipients no later than early May. We hope this helps.

The O.

17 April, 2020

Ijust spoke to a Grocery Store Clerk and she said she got her Stimulus Automatic Deposit yesterday (Through Bank of the West here in New Mexico) and the News Media is reporting that the Social Security recepients are being processed next, I expect you may all see the Automatic deposits next week at the earliest. I need mine to pay my lawyer to sue the airlines for not allowing me to to take my comfort animal (Pet Giraffe) on board the Aircraft. But seriously, hang in there relief is on the way sooner than later.

Jack

Senior with no money, food or gas in the car, and I have to wait for stimulus payment because I am on Social Security, Why? Can anyone provide an answer as to when those of us on SS can expect the stimulus payment will be deposited to our accounts

Vonda V.

Hi Jack, thanks for using our blog. Treasury expects automatic payments for Social Security beneficiaries no later than the end of April and automatic payments for SSI recipients no later than early May.

Twila H.

You got your regular check still….did you spend it all on paper towels or something? Should have paid your bills first.

Joe

I am just asking a question, one I assume I know the answer too, but I am still going to ask to see if I can get some clarification. Obviously I understand that not all of the payments have likely been direct deposited as of yet. However, I am on RSDI, and since mine has not yet, i went to the site that was launched to track the payments. After putting in my infromation, I get this:

Payment Status Not Available

According to information that we have on file, we cannot determine your eligibility for a payment at this time.

I am guessing that this is what we all would get if we are checking that tool, and did not file taxes because we are on either SSI or RSDI. But I wanted to ask and be certain that this is the case, and I should not be concerned.

Thank you for your time and response.