See What You Can Do Online!

Reading Time: 1 MinuteLast Updated: August 19, 2021

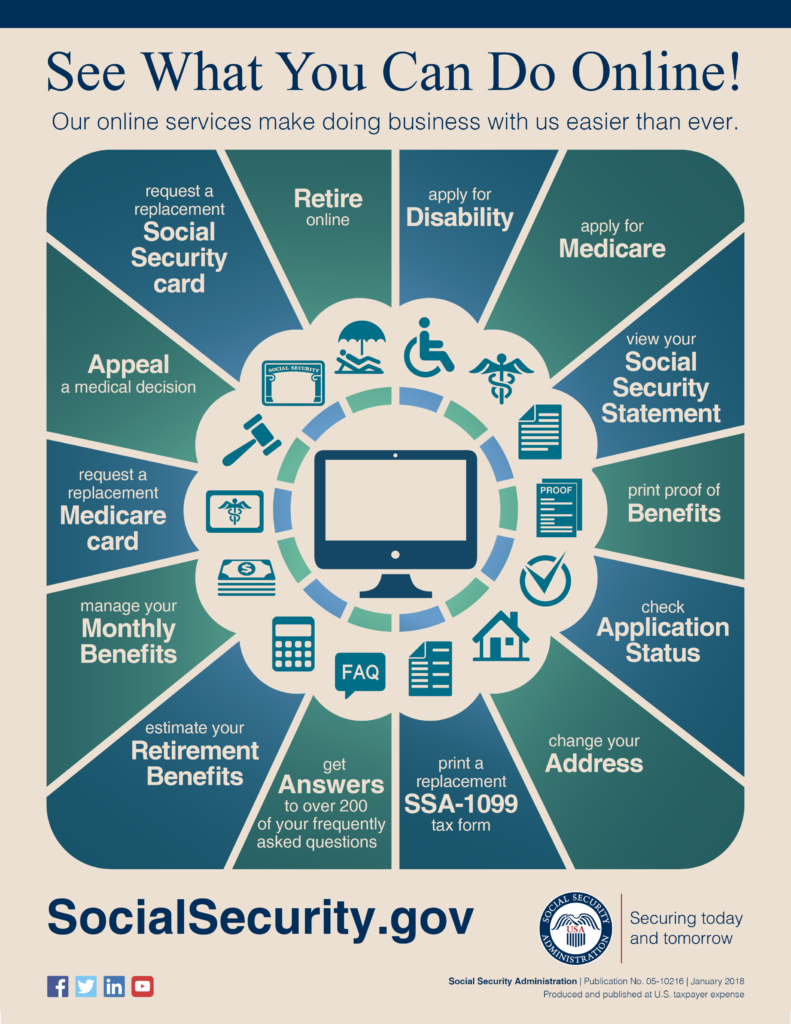

For over 80 years, Social Security has changed to meet the needs of our customers. Today, our easy, secure, and convenient-to-use online services allow you to do business with us from the comfort of your preferred location. From requesting a Social Security card to filing for retirement, our online services have got you covered. Check out our infographic, which shows what you can do online:

Did you find this Information helpful?

Tags: retirement benefits, Social Security benefits

See CommentsAbout the Author

Comments

Comments are closed.

Brenda G.

How can I get a form to have taxes taken out of my social security check

A.C.

Thanks for your question, Brenda. In order to have taxes withheld from your Social Security benefit, you must start by printing, completing and submitting an IRS Voluntary Withholding Request Form (Form W-4V). On this form, you can choose to have 7, 10, 12, or 22 percent of your monthly benefit withheld. The Form W-4V (to withhold federal taxes from your Social Security benefits) can be returned to your local Social Security office by mail or in person. See our Benefits Planner: Withholding Income Tax From Your Social Security Benefits web page for more information. We hope this helps.

Eliisa M.

In filing online for Medicare there is no place to sign the document and submit it. It just says save and exit. How does one sign it and submit it?

Thanks

A.C.

Hi, Eliisa. We are sorry to hear you are having difficulty with your online application for Medicare. For your security, we do not have access to private information in this venue. You can call us at 1-800-772-1213, Monday through Friday, between 7:00 a.m. and 7:00 p.m., for assistance. Generally, you will have a shorter wait if you call later in the day. You can also contact your local Social Security office. We hope this helps.

Charlotte M.

I am currently receiving social security benefits based on my husband’s account. I will turn 70ty years old in May and would like to begin drawing from my account at that time.

A.C.

Hi, Charlotte. Since you are currently receiving benefits, you will need to contact us to set up an appointment to file for benefits on your own record. You can call us at 1-800-772-1213, Monday through Friday, between 7:00 a.m. and 7:00 p.m. for assistance. You can also contact your local Social Security office. Thanks!

Melody L.

Good day, I did not receive my direct deposit social security check this month of Feb.. I have previously had no issue receiving my checks on the 23rd of each month. But today being the 26th of Feb. and no check received yet.

Please advise.

Thank You

916-342-6286

A.C.

Hi, Melody. If you do not receive your payment on the scheduled pay date, please contact your bank or financial institution first. They may be able to determine why your direct deposit failed. If you still need to report a late, missing, or stolen Social Security payment, call us toll-free at 1-800-772-1213 or contact your local Social Security office. We will review the case and if the payment is due, we will replace it. You may also find the Schedule of Social Security Payments calendar useful. Thanks.

Janice M.

When will I receive my 1099 for 2018? I am waiting for this for to file my 2018 income tax

A.C.

Hi, Janice. You can request a replacement SSA-1099/1042S for Tax Year 2018 by visiting your personal my Social Security account. You can also contact or visit your local office. They can assist with a replacement 1099. We hope this helps.

Patricia A.

I just got a call from 936 730-2001 telling me there was fraud on my SS# and that I needed to call that number.

I did and got a man with a heavy accent that told me he needed my ss# and date of birth to help me with the fraud. He said his name is Lee Wilson and his ID # is GS2531.

I told him this did not sound right to me and I was not giving any info. He said I could call any police station and they would verify his ID info.

Sounds like a scam to me. Please check and advise me.

A.C.

Hi, Patricia. Thanks for letting us know. We do not usually make random calls. If anyone receives calls saying that they are from Social Security, do not give out any personal information. Suspicious calls should be reported to the Office of the Inspector General at 1-800-269-0271 or online. You can find additional information here. Thanks, again!

Marion G.

At the present time my ss check is direct deposit to checking account #3301689770, routing #011402533 and I have opened another account #3315574253, routing #011401533 because of a problem and am notifying SS to direct future direct deposits to Citizens Bank, Manchester, NH, at your earliest convenience.

I hope this is enough information.

Kelly R.

Just received a call and voicemail from +1(866)404-8958 stating that SS has suspended my SS# due to suspicious activity. Is this a scam?

Kelly R.

Just rec’d another robot voicemail from a different # +1(866)404-9329. Same message

V.V.

Hi Kelly: Thanks for letting us know. If the caller is claiming to be from Social Security—it is critical that you pay attention to the tone and content of the message from the caller. In some cases, the caller states that Social Security does not have all of your personal information, such as your Social Security number (SSN), on file. Other callers claim Social Security needs additional information so the agency can increase your benefit payment, or they threaten that Social Security will terminate your benefits if they do not confirm your information. This appears to be a widespread issue, as reports have come from people across the country. These calls are not from Social Security.

If you receive a call from someone claiming to be from Social Security, we urge you to always be cautious and to avoid providing sensitive information such as your SSN or bank account information. Never reveal personal data to a stranger who calls you, and never send the stranger money via wire transfer or gift cards.

Social Security employees will never threaten you for information; they will not state that you face potential arrest or other legal action if you fail to provide information or pay a fee. In those cases, the call is fraudulent, and you should just hang up. If you receive these calls, report the information to the Office of the Inspector General at 1-800-269-0271 or online at oig.ssa.gov/report.

HAMID G.

what is the form or the application should I download and fill to change my status from a permanent resident to a citizenship status

V.V.

Congratulations, Hamid! You will need to visit your local Social Security office or your local Social Security Card Center to update your Social Security record. Please bring with you, your Certificate of Naturalization and complete an application for a replacement card. All documents you submit must be either originals or certified copies by the issuing agency. We cannot accept photocopies or notarized copies of documents. Any documents you provide will be returned to you.

Visit our Social Security Number and Card web page for additional details.

Sam J.

I am a non-immigrant alien student and I have a social security card which was issued for getting my driver’s license in the past. The type of my social security card is ‘not valid for employment’.

If I need to get a general SSN now for a tax report, should I apply for a new SSN? Or, may I apply for a replacement card through your online service?

V.V.

Sam, thank you for your question. Check out our Frequently Asked Questions web page for details on how to change your work status on your card.