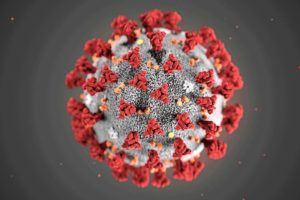

Coronavirus (COVID-19): Important Information about Social Security Services

Reading Time: 1 MinuteLast Updated: February 21, 2023

All local Social Security offices will be closed to the public for in-person service starting Tuesday, March 17, 2020. This decision protects the population we serve—older Americans and people with underlying medical conditions—and our employees during the Coronavirus (COVID-19) pandemic. However, we are still able to provide critical services.

All local Social Security offices will be closed to the public for in-person service starting Tuesday, March 17, 2020. This decision protects the population we serve—older Americans and people with underlying medical conditions—and our employees during the Coronavirus (COVID-19) pandemic. However, we are still able to provide critical services.

Please read our press release to learn more, including how to get help from the Social Security Administration by phone and online. You can also visit our website to learn more and stay up to date.

Please share this message with your friends and loved ones.

Did you find this Information helpful?

Tags: COVID-19, social security, Social Security benefits

See CommentsAbout the Author

Comments

Comments are closed.

C h.

You don’t have to work if you are disabled we the tax payers pay your way ..wanting more grow up !,, I truly feel sorry for the elderly and physically disabled although the scam that many have put off on the tax payers is sick …bad backs and depression I work every day with scoliosis and herniated discs doing construction to pay for my kids school oh and u

James

Yeah, you do realize all these people paid social security taxes their entire lives in order to receive social security benefits right? If the world is indeed coming to an end I hope it’s people like you that go first, otherwise we’re all screwed.

Pat

Thank you for responding to this person . I was seriously ready to go off on him till I read your reply. But doesn’t really matter anyway because they don’t listen. I paid into Social Security for almost 30 years worked in a factory my last 10 years of working it was a fiberglass factory now I’m on disability so I paid my dues to disability and I am owed the money it’s mine I put it in there. I’m not on welfare and I’m also raising a 17-year-old grandson. Thank you to all the people who think that we who are on Social Security disability are robbing money from you we art have a great day

Pops

You didn’t pay anything for me, I worked 70 hrs a week for forty-two years and then was exposed to toxic fumes that ruined my lungs. But those 42 years I worked two lifetimes. So just shut it.

Kari

Amen to that.

Bobby T.

Actually, we disabled people paid for our own disability/SSDI payments with OUR OWN taxes… not you. Taxpayers do not “pay our way”—I EARNED my SSDI payments and am now condemned to a life of poverty because I cannot work full time anymore. Very few people can actually “scam the system” to receive SSDI. SSI is a different thing entirely. Also, plenty of people on SSDI do in fact, work. And typically work low paying, low hours jobs. So please, do not think that those of us receiving SSDI have it “easy”, that we are lazy, or that we did not earn our payments, because we did.

LORD, H.

https://www.washingtonpost.com/business/2020/03/17/checks-virus/

In the last recession, checks went out to

pretty much everyone who wasn’t a millionaire and filed a U.S. tax return, including Social Security recipients. Americans earning at least some income but less than $75,000 got the full amount, while wealthier people got less. The payments were sent by a check in the mail or direct deposit into a bank account.

J m.

Does anyone believe what come out of poliiticans mouth.they say anything to smoth the plan and just do what ever.if the rich get a check everyone is entitled to there share

Google

https://www.irs.gov/newsroom/economic-stimulus-payments-information-for-recipients-of-social-security-benefits

JUDITH k.

if you filed no taxes will u get the stimulus check also if you only get s.s. will u get a stimulus check.

thank you for any answer. stay safe and healthy

poor

If you’ve been following the news on the Stimulus Check it’s been publicly stated that 75% of Americans will qualify. Roughly 20% of Americans are on SSI SSDI, guess who that 25% who will more than likely NOT qualify will be?

With that being said if the 2020 Stimulus requirements follow past requirements you will:

1. Have to have filed a 2019 income tax return

2. Not be claimed as a dependent on someone else’s return.

3. Meet a minimum earned income which includes

net profit from self employment, Social Security but not SSI or SSDI. The minimum will likely be at

around $3200-3500.

So you may still qualify for the stimulus check if you are on disability.

Rae A.

Is the 3200-3500 a month or a year?

A s.

Ok I get SSI .I worked for years but didn’t get approved for disabled (got hurt at work) until after my credits ran out. I have several children and live of of the $783 a month and have to rotate bills each month to pay so they don’t get disconnected. So do I get the stimulus package? I don’t get enough $ to pay my bills each month and I don’t get enough Foodstps to come close to feeding my family. I have to go to food banks that are now closed. So what do I do? Where do we get help?

A.C.

Hi. We are sorry to about your situation. You may be eligible to receive social services from the state in which you live. These services include Medicaid, free meals, housekeeping help, transportation or help with other problems. To find out whether you may qualify and if you need to file a separate application call the Centers for Medicare & Medicaid Services at 1-800-633-4227 (TTY, 1-877-486-2048). You also can get information about services in your area from your state or local social services or welfare office. We hope this helps.

Dauwn w.

I was ask are we get paid next month too cuz we got bills to pay rent Gas phone foods stuff I need for my house

poor

You are eligible if:

You or your family has at least $3,000 in qualifying income from, or in combination with, Social Security benefits, Veterans Affairs benefits, Railroad Retirement benefits and earned income. Supplemental Security Income (SSI) does not count as qualifying income for the stimulus payment.

You and any family members listed on your tax return have valid Social Security numbers.

You are not a dependent or eligible to be a dependent on someone else’s federal tax return. (The same must be true of any family members claimed on your return.)

Source: https://www.irs.gov/newsroom/economic-stimulus-payment-information-center

These eligibility requirements will be applied to the 2020 Stimulus check requirements with the minimum earned income adjusted upwards from the 2009 $3000 minimum…likely the minimum will be anywhere from $3200-3500+.

Pops

That was for 2009 FYI.

Poor l.

If you do some research you will find that to qualify for the 2020 Stimulus Check:

1. You have to have filed a 2019 tax return.

2. You cannot be claimed a dependent on someone else’s return

3. You must have earned income of a minimum amount to be determined but more than likely will be around $3200 (this includes any self employment – net amount, SS). That means you can still receive SSI and qualify.

The payments will be made direct deposit if you filed a tax return and had a refund as direct deposit otherwise a check will be mailed.

James

Not true. They said 2018 tax return. The 2019 return isn’t even due yet.

sickdude

i have been trying toget ssdi for the past year so i havent been able to file taxes, would i qualify