What is FICA

Reading Time: 1 MinuteLast Updated: March 20, 2017

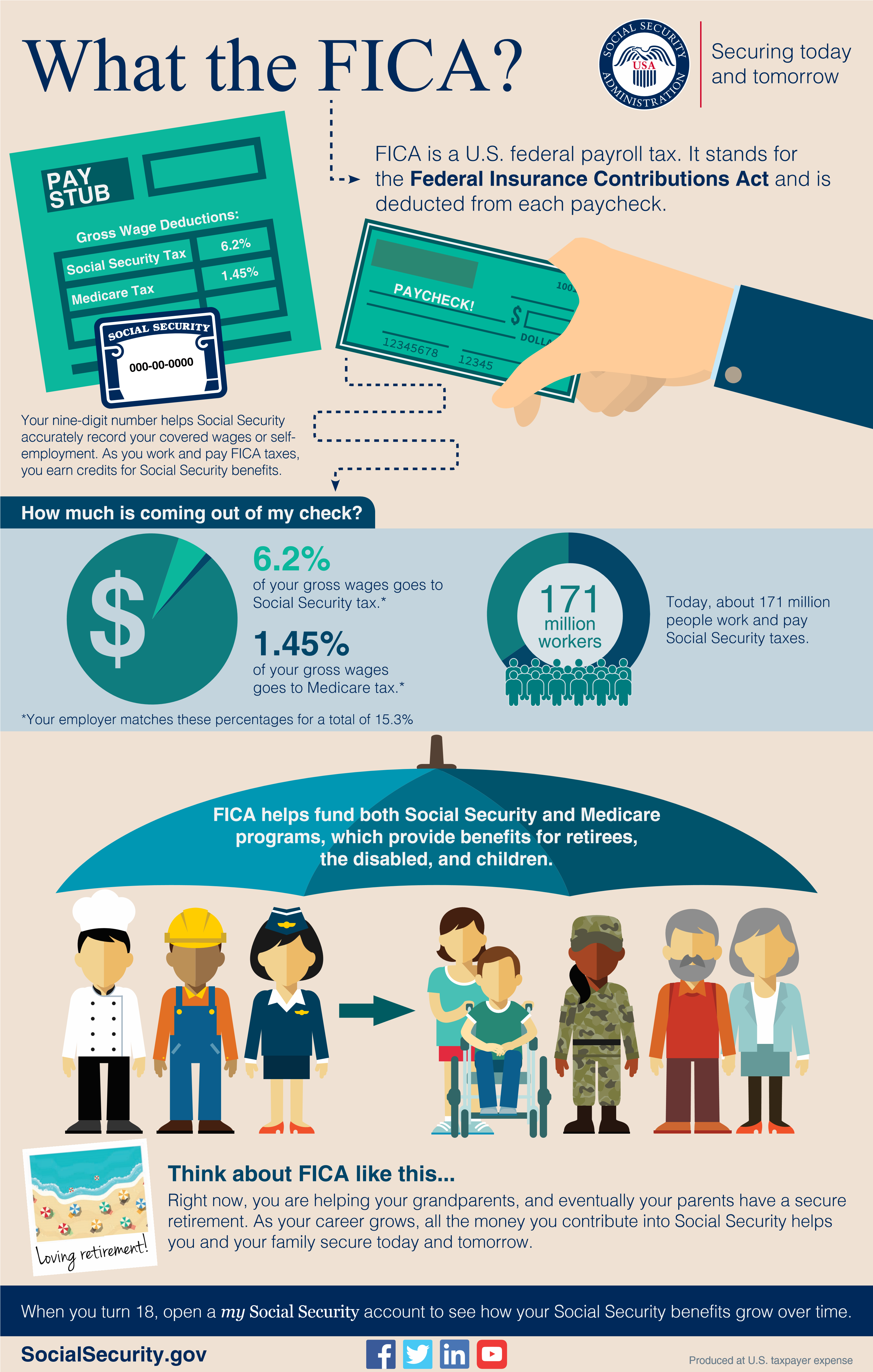

FICA taxes help provide benefits for retirees, disabled people and children. This contribution helps your parents and grandparents have a secure retirement while securing today and tomorrow for you and your future family. Learn more about FICA.

Did you find this Information helpful?

Tags: Disability, FICA, Medicare, retirement benefits, Social Security benefits, Social Security taxes

See CommentsAbout the Author

Comments

Comments are closed.

fernando

do i need to pay fica even idont have sss no IIworked in offshore for 10 years withB1OCS my employer deducted evry check is it legal and im from the Philippines thank you very much for the answer

V.V.

Hi Fernando, thanks for using our blog. Although we can’t refund correctly paid U.S. Social Security taxes and contributions, you still may be able to get benefits based on those tax contributions. Check out our Frequently Asked Questions web page for more information.

fernando

thank you very much to you , i lived now in philippines and i dont have sss number how can i file or where can i get the form for benefits if Im elegible

V.V.

Hi Fernando. We recommend that individuals living outside the United States contact the nearest Federal Benefit Unit in the area for any assistance related to Social Security programs and benefits. Also, our Office of International Operations home page provides more information to assist our customers living abroad.

John M.

will I need to continue paying Fica if I quit work and am only drawing from my 401K until able to retire? And what percent if I do?

V.V.

Hi John, thanks for using our blog. If you’re asking about paying Social Security taxes, there is no exemption for paying the Federal Insurance and Self-Employment Contribution Acts (FICA and SECA) payroll taxes that fund the Social Security and Medicare systems. As long as you work in a job that is covered by Social Security, FICA taxes will be withheld from your paycheck. The same goes if you remain actively self-employed.

Charlotte Y.

I would like to arrange to have a percentage of my Social Security payment pay my taxes during the year.

V.V.

Thank you for using our blog, Charlotte. You can download the form or call the IRS toll-free at 1-800-829-3676 and ask for Form W-4V. When you complete the form, you can choose to have 7, 10, 12, or 22 percent of your monthly benefit withheld for taxes. You can mail the completed form to your local Social Security office.

Check out our Benefits Planner: Withholding Income Tax From Your Social Security Benefits for more information.

khemraj g.

when i retire at 63 and still working how much i am allowed to work for not to pay taxes

V.V.

Hi Khemraj. If you’re asking about Social Security retirement benefits, you may start receiving benefits as early as age 62 or as late as age 70. Monthly benefits are reduced if you start them any time before your “full retirement age”. Your full retirement age depends on your date of birth. It may be between age 66 and 67. This could affect the amount of your benefits and when you want the benefits to start.

The Benefits Planner: Retirement provides detailed information about Social Security retirement benefits.

sis

Also – read Helvering vs Davis. SS is unconstitutional but the Supremes decided otherwise.

bonnie s.

Advertise on Hi!

Hope you are having a great day! I have come across your site, and I strongly feel that your website is a perfect match for us.

We are trying to create awareness regarding our Amazon Books,Mobile app,Resume app,Entertainment site,Fashion store site and Easily accessible SEO tools & Services available to users worldwide. How about starting a collaboration and making a collective effort?

You can help us by placing a piece of writing (Article/Link/Banner ads) on your website.

The price is negotiable if you are interested.

Looking forward to hearing from you soon.

Thanks & Regards

bonniesikes3@gmail.com

Joel W.

A good overview. Is there an age limit where FICA taxes are not taken from the worker or their employer?

L.A.

Hi Joel. Thanks for your question. The Federal Insurance and Self-Employment Contribution Acts (FICA and SECA) require the withholding of taxes from wages of all employed people, and the net earnings of most self-employed people, for the Social Security and Medicare programs. Therefore, you will continue to pay taxes regardless of age. We hope this helps.

Herschel A.

Hello, after reading this amazing article i am as well happy to share my familiarity here with mates!|

http://www.scrapebox.com/email-scraper-plugin

ROBERT C.

I need to start withholding taxes from Social Security Check. I do I get it done. Thank you.

A.C.

Hi, Robert. In order to have taxes withheld from your Social Security benefit, you must start by printing, completing and submitting an IRS Voluntary Withholding Request Form (Form W-4V). On this form, you can choose to have 7, 10, 12, or 22 percent of your monthly benefit withheld. The Form W-4V (to withhold federal taxes from your Social Security benefits) can be returned to your local Social Security office by mail or in person. See our Benefits Planner: Withholding Income Tax From Your Social Security Benefits web page for more information. We hope this helps.

Ethel w.

I need help in getting Social security to stop taking federal taxes out of my check. I call last year January 2018 and they want stop. Please help

V.V.

Hi Ethel, sorry to hear about the difficulties you are having with Social Security. To stop your withholding, you’ll need a Form W-4V from the Internal Revenue Service (IRS). You can download the form or call the IRS toll-free at 1-800-829-3676 and ask for Form W-4V. Sign the form and return it to your local Social Security office by mail or in person.