See What You Can Do Online!

Reading Time: 1 MinuteLast Updated: August 19, 2021

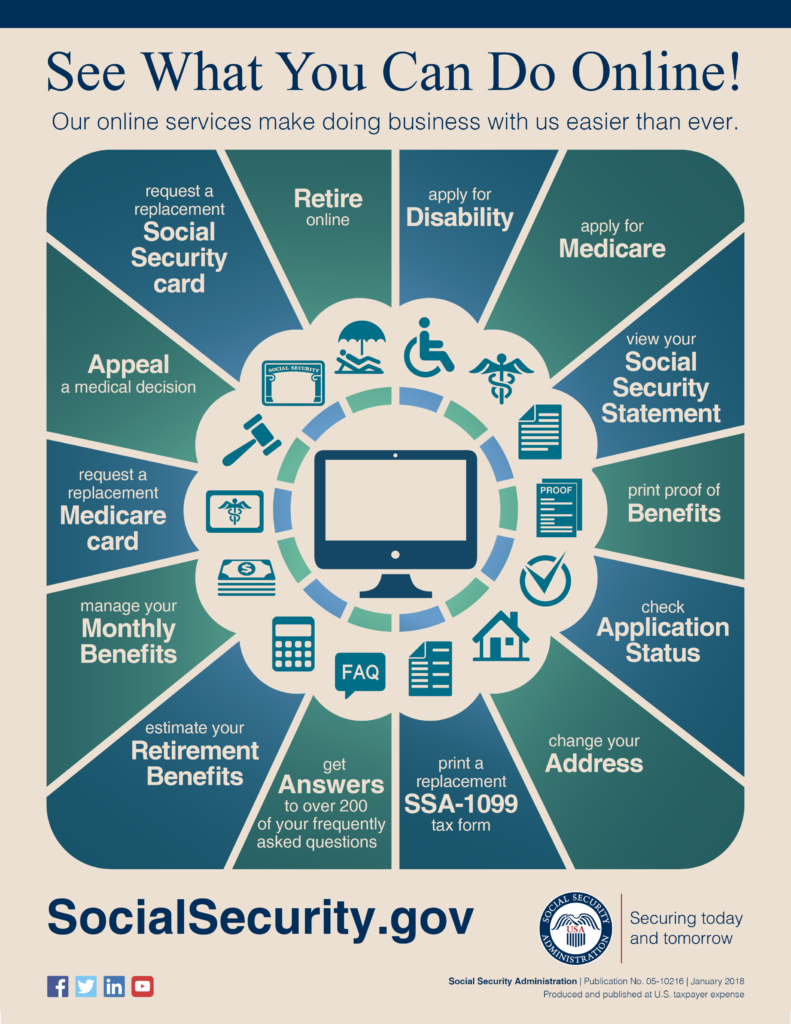

For over 80 years, Social Security has changed to meet the needs of our customers. Today, our easy, secure, and convenient-to-use online services allow you to do business with us from the comfort of your preferred location. From requesting a Social Security card to filing for retirement, our online services have got you covered. Check out our infographic, which shows what you can do online:

Did you find this Information helpful?

Tags: retirement benefits, Social Security benefits

See CommentsAbout the Author

Comments

Comments are closed.

William G.

I was self employed 40 yrs over that time I made a utility stock my retirement which paid a dividend every quarter they sold the company I had no choice but to take capital gains SSA told us our benefits would be cut can I appeal this to get my benefits back to what they were

JANICE C.

I need a password reset code A.S.A.P.

Sherri B.

My husband pass away this last week.

What do I need to do, and how?

S.D.

We are so sorry for your loss, Sherri. Typically, the funeral director notifies us of an individual’s passing by contacting the local Social Security office. To verify this information was reported, you can call us at 1-800-772-1213 or your local Social Security office. You’ll find the phone number at the Office Locator. Our call volume and wait times are longer than normal, so please be patient. You may need to schedule an appointment to file for a one-time lump sum death payment of $255 and discuss your eligibility for widow’s benefits. Please see our How Social Security Can Help You When a Family Member Dies fact sheet. We hope this information helps.

Corinne B.

I was widowed at age 28 in 1976 but i remarried in 1988 and have now divorced my second husband as of 04/2007. He was on SSDI shortly prior to our divorce. I went on SSDI in 2010, im now 62. Can I receive and surviving widow benefits from my late husband and/or my ex-husband of 18 years of marraiges as we both receive SSDI monthly. I believe his is somewhat higher than what I receive and at this time I dont know if hes still living but i expect he is, have no way of knowing that for sure. We quit communicating a few years after our divorce. There are no childrem involved what so every between myself and my ex-husband. My later husband that passed on in 1986 had 3 girls long since grown to bring well over dependent age after like 34 years. I do have marriage and death vertificate of late husband and SS#. I also have marriage and divorce decree and SS# of my ex-husband but being almost 14 years i do not have a paycheck stubs or W2 any longer on im. How do i go about applies for both spouses to see if i can get any increase in my SSDI via part of one or both husbands. And how would i determine if my ex-husband is still living or doesnt it matter as far as applying for divorced spouse benefits. He will not be 62 until august 18th 2021, but from what i read, if im 62, his birthday to turn 62 shoulx not matter!! Ive read high and low and it seems my situation is unusual as i havent been able to to find this exact same senario in the SS documents ive read several times now. I just seem to get bits and pieced which im not able to piece together to get a solid for sure answer. If i can possible get more benefits through one or both of m spouses, how do i go about applying for the widow and divorced spouse benefits on these guys? Seems im the odd one out here!!!

Thank you for any help you can advise me of steps of action i need to take!!! This seems to be rather complicated for my situation so i need some expert advice and instruction, please!!! Thank you very much.

Corinne Bradley

V.V.

Hi Corinne, thanks for using our blog. If you are the divorced spouse of a worker who dies, you could get benefits the same as a widow or widower, provided that your marriage lasted 10 years or more. Benefits paid to you as a surviving divorced spouse won’t affect the benefit amount for other survivors getting benefits on the worker’s record. If you remarry after you reach age 60 (age 50 if disabled), the remarriage will not affect your eligibility for survivors benefits.

You may be able to receive full benefits at your full retirement age for survivors or reduced benefits as early as age 60.

Check out our Survivors Planner web page for additional details.

You cannot file for surviving divorced spouse’s benefits and divorced spouse’s benefits, but you can file for the higher of the two.

Your benefit as a divorced spouse can be equal to one-half of your ex’s full retirement amount only if you start receiving those benefits at your full retirement age. If you begin to receive benefits at age 62 or prior to your full retirement age, your benefits are reduced. The reduction factors are permanently applied to all of the benefits you qualify for once you opt to start benefits at age 62 or at any time prior to your full retirement age.

Remember, if you qualify for your own disability benefits and for benefits as a divorced spouse, we always pay your disability benefits first. If your benefits as a divorced spouse are higher than your own benefits, you will get a combination of benefits equaling the higher divorced spouse benefit. However, the divorced spouse’s benefit cannot exceed one-half of your ex-spouse’s full retirement amount (not the reduced benefit amount). So, you can only receive additional benefits if your disability benefit is less than half of your ex-spouse’s full retirement benefit.

Check out our Benefits for a Divorced Spouse web page for other eligibility requirements and more detailed information.

To inquire about potential benefits, you can call us at 1-800-772-1213 or you can contact your local Social Security office. Please look for the general inquiry telephone number at the Social Security Office Locator. The number may appear under Show Additional Office Information. Please be aware that our call wait times are longer than normal. We hope this information helps.

Johnny B.

I currently receive SSA payment but I have worked part time since I started. I pay in to Social Security through payroll deductions. Will my monthly payment increase after 40 quarters or at any time?

S.D.

Hi, Johnny. Thank you for reading our blog and asking your question. Each year we review your work record. If your earnings for the prior year are higher than one of the years we used to compute your benefit, we will recalculate your benefit amount. (See our fact sheet, Your Retirement Benefit: How it’s Figured.) However, our automatic recalculation may not occur until later in the calendar year. If you are due an increase, we will send you a letter to notify you of your new benefit amount and pay you any increase retroactive to January of the year after you earned the money. For more details, see our Frequently Asked Questions web page and our Receiving Benefits While Working web page.

Betty J.

How can I find a job I have many disabilities which now even include not being able to talk

Reba C.

how do i get my check took out of a checking account and put back on a card?

Pamela R.

In order to apply for my monthly pension I need a employee workout history of when I was hired to my last day of working.

Pamela R.

In order to apply for my monthly pension I need a employee workout history of when I was hired to my last day of working for Pathmark Suoermarket. How can I obtain this?

V.V.

Hi Pamela, thanks for using our blog. Check out our Frequently Asked Questions web page for details on how to obtain a detailed earnings statement. Hopefully this helps!

Janie D.

Help me find my check

V.V.

Hi Janie, thanks for using our blog. If you did not receive your Social Security or SSI benefit, please contact your bank or financial institution first. They may be able to determine if your direct deposit failed. If you still need to report a late, missing or stolen Social Security payment, call us toll-free at 1-800-772-1213 for assistance or you can contact your local Social Security office. Please look for the general inquiry telephone number at the Social Security Office Locator. The number may appear under Show Additional Office Information. Please be aware that our call wait times are longer than normal. We hope this information helps.

Juliette H.

I just want/need to submit a digital copy of bank statements so my benefits can be processed!(with no interruption) I’m spending hours, literally just trying to find a link with the Henrico SS website so renewal is possible! Called my local SS OFFICE AND NOTHING IS BEING DONE! But mind you, they’ll stop assisting with your Medicaid payment to SS, in a heartbeat! Then it’s your responsibility to clean up the mess they made!

V.V.

For your security, Juliette, we do not have access to private information in this venue. We ask that members in our Blog community work with our offices with specific questions. You can call us at 1-800-772-1213 for assistance or you can call your local Social Security office. Please look for the general inquiry telephone number at the Social Security Office Locator. The number may appear under Show Additional Office Information. Please be aware that our call wait times are longer than normal. We hope this information helps.