See What You Can Do Online!

Reading Time: 1 MinuteLast Updated: August 19, 2021

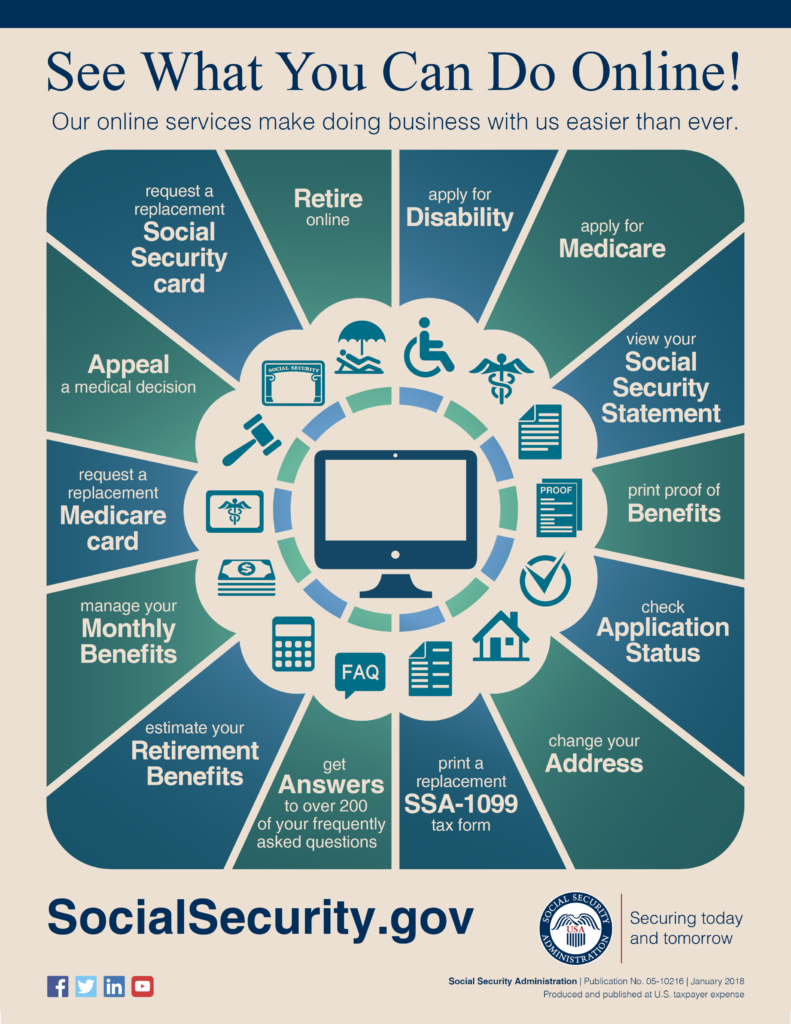

For over 80 years, Social Security has changed to meet the needs of our customers. Today, our easy, secure, and convenient-to-use online services allow you to do business with us from the comfort of your preferred location. From requesting a Social Security card to filing for retirement, our online services have got you covered. Check out our infographic, which shows what you can do online:

Did you find this Information helpful?

Tags: retirement benefits, Social Security benefits

See CommentsAbout the Author

Comments

Comments are closed.

Leatha S.

I am 51 yrs. With RA in all joints Doctors have already said I will not ever work again.

I have a 11yr. Son that lives with me .I am a single parent that have worked since I was 15. I have already have been evicted because i couldnt pay rent and Bill’s and food. My medications are $200.00 a month alone I cant get medical or medicaid. My rent is 550.00 and that isnt counting the Bill’s. I only get $920.00 and I live with just my son and me. I have tried everything to get help but I have been de lied for food stamps and medical or any kind of prescription help. We will end up homeless again. No one can raise a child and live on $920 I cant even get all my medications for my bi-polar and depression Please help me and my son.

A.C.

Hi, Leatha. We are sorry to hear about your situation. You may be eligible to receive social services from the state in which you live. These services include Medicaid, free meals, housekeeping help, transportation or help with other problems. To find out whether you may qualify and if you need to file a separate application call the Centers for Medicare & Medicaid Services at 1-800-633-4227 (TTY, 1-877-486-2048). You also can get information about services in your area from your state or local social services or welfare office. We hope this helps.

Martha M.

I am interested to see if I get additional benefits because my ex-spouse died. I don’t remember his social security number. His name is John Alden McDonald and his birthdate is November 21, 1940 I think. I know it was November 21 and I think it was 1940 but I could be wrong on that. He was retired from the Navy and he had his own business as a welder.

A.C.

Hi, Martha. Thanks for your comment. If your marriage lasted for at least 10 years, your may be eligible for surviving divorced spouse benefits based on your ex-husband’s earnings, beginning at age 60. If you are disabled, you could begin receiving benefits as early as age 50 if the disability started before or within 7 years of your ex-husband’s death. For additional information on Survivor benefits, check out our Survivors Planner . For specific questions, please call us at 1-800-772-1213, Monday through Friday, between 7:00 a.m. and 7:00 p.m., for assistance. Generally, you will have a shorter wait if you call later in the day. You can also contact your local Social Security office. We hope this helps.

Eleanor S.

can I receive more money from my ex husbands social security ?

A.C.

Thanks for your question, Eleanor. To be eligible for divorced spouse benefits, you had to be married to your former spouse for at least 10 years, and you cannot be eligible for a higher benefit on your own record. For more information on how to qualify for divorced spouse benefits, visit here. For specific questions, please call us us at 1-800-772-1213, Monday through Friday, between 7:00 a.m. and 7:00 p.m., for assistance. Generally, you will have a shorter wait if you call later in the day. You can also contact your local Social Security office. We hope this helps.

Susan W.

My husband passed away 5 years ago. I will be turning 60 in 6 months. Do I qualify for survivors benefits at 60?

A.C.

Hi, Susan. We are sorry for your loss. You are eligible to apply for survivor benefits when you reach age 60 (age 50 or over if disabled). For more information about widow’s benefits, check out our Survivors Planner. For specific questions, please call us at 1-800-772-1213, Monday through Friday, between 7:00 a.m. and 7:00 p.m., for assistance. Generally, you will have a shorter wait if you call later in the day. You can also contact your local Social Security office. We hope this helps.

MARIA M.

SETUP APPOINTMENT

A.C.

Hi, Maria. You can schedule an appointment with your local office by calling us at 1-800-772-1213 between 7:00 a.m. to 7:00 p.m., Monday through Friday and a representative will assist you. Thanks!

Ming I.

When I first tried to log in to the My Account, it asked for answers to three questions, which I provided. But who can remember whether they used capitals or not? your system rejected them, with no explanation, even though initial caps were not there in the original (I didn’t even remember the questions, to tell you the truth, but I knew the answers). Can’t your programmer make capitalization irrelevant for this step?

A.C.

Hi, Ming. If you are still unable to access your account or encounter another problem with your personal my Social Security account, you may:

•Call us at 1-800-772-1213 (TTY 1-800-325-0778), Monday through Friday, between 7:00 a.m. and 7:00 p.m. At the voice prompt, say “help desk”; or

•Contact your local Social Security office. We hope this helps.

David K.

How can I change my voluntary deductable for 2020/

A.C.

Hi, David. It sounds like you are referring to the voluntary tax withholding. In order to have taxes withheld from your Social Security benefit, you must start by printing, completing and submitting an IRS Voluntary Withholding Request Form (Form W-4V). On this form, you can choose to have 7, 10, 12, or 22 percent of your monthly benefit withheld. The Form W-4V (to withhold federal taxes from your Social Security benefits) can be returned to your local Social Security office by mail or in person. See our Benefits Planner: Withholding Income Tax From Your Social Security Benefits web page for more information. We hope this helps.

Roberta S.

At 76, I have recently (November1) quit my job.

When I got my job, 2.5 years ago, I was no longer eligible for a discount on my medicare payment.

Now unemployed and with the deduction up to 144.60,it has a considerable impact on my quaity of living.

I currently am part of Silver Script (which helps a lot) but could cerainly use the $144.60.

A.C.

Hi, Roberta. You may be eligible to receive assistance from the state where you live. Medicare enrollees who have limited income and resources may get help paying for their premiums and out-of-pocket medical expenses through the Medicare Savings Programs (MSP). Please call the Centers for Medicare & Medicaid Services at 1-800-633-4227 for more information. We hope this information is helpful.

Roger H.

How do a I set up an appointment at my local Social Security office? I need to remove my Medicare Part B coverage. I have submitted the proper forms to have the coverage termed effective 11/1/2019 (which would remove the payment in December), but it still shows on my account when I sign in.

A.C.

Hi, Roger. If you still need to schedule an appointment with your local office by calling us at 1-800-772-1213 between 7:00 a.m. to 7:00 p.m., Monday through Friday and a representative will assist you. Generally, you will have a shorter wait if you call later in the day. We hope this helps.

Leon

How many credit weeks do I need

A.C.

Thanks for your question, Leon. Credits are the “building blocks” we use to find out whether you have the minimum amount of covered work to qualify for each type of Social Security benefits. No benefits can be paid if you do not have enough credits. Visit our Benefits Planner page here for more information. We hope this helps.