See What You Can Do Online!

Reading Time: 1 MinuteLast Updated: August 19, 2021

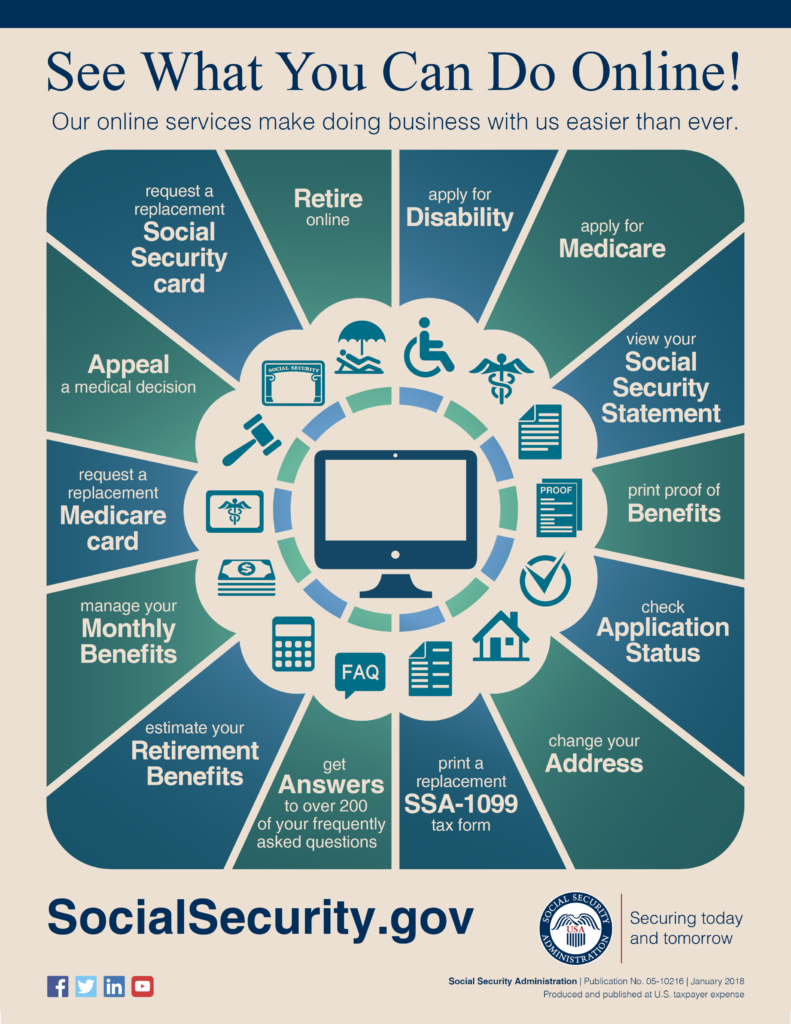

For over 80 years, Social Security has changed to meet the needs of our customers. Today, our easy, secure, and convenient-to-use online services allow you to do business with us from the comfort of your preferred location. From requesting a Social Security card to filing for retirement, our online services have got you covered. Check out our infographic, which shows what you can do online:

Did you find this Information helpful?

Tags: retirement benefits, Social Security benefits

See CommentsAbout the Author

Comments

Comments are closed.

Maria Y.

Need to update my phone number

A.C.

Hi, Maria. If you are receiving Social Security retirement or disability, you can create a my Social Security account to change your address online. If you are receiving Supplemental Security Income, you should contact your local Social Security office immediately. Thanks!

Wayne T.

I need to take taxes out of my ss disability. Would anyone know how I would go about doing this?

Bridget S.

I requested a password update on March 28th 2019 and today is April 26th. I have not received it in the mail yet. Please advise.

Thank you

Bridget Sheehy

V.V.

Hi Bridget, thank you for using our blog. We do offer various ways for you to reset your password. See our Frequently Asked Questions web page for more details.

Unfortunately, if that doesn’t help and you need assistance, you may:

•Call us at 1-800-772-1213 (TTY 1-800-325-0778), Monday through Friday from 7 a.m. to 7 p.m. At the voice prompt, say “helpdesk”; or

•Contact your local Social Security office.

John S.

Is there a place or address where I can ask specific questions about what my wife will continue to draw upon my death? Im not having health problems right now. I’m just trying to do some planning.

A.C.

Thank you for your question, John. Your wife could be eligible for reduced widow’s benefits as early as age 60 (age 50 if disabled). For more information, please go to our Survivors Planner page and read our publication: How Social Security Can Help – When A Family Member Dies. We hope this helps.

Robyn

I don’t know how to tell you how to get over this,

exactly. Sometimes younger people have a hard time accepting that older people,

especially their parents, are sexual. Usually, time and growing up some more takes

care of it.

Ronald D.

Jim,

The one thing I haven’t been able to find on-line is how I can inform a person’s supervisor of the outstanding service I have received from the staff at the Social Security Administration office in Chambersburg, PA.

If a link exists can you have someone send it to me?

Cordially,

Ron De Munbrun

Susan J.

After I entered “make an appointment” in the search bar, the result indicated that I can make an appointment with my local office online. However, I have not been able to find the link / page to do this. How can I make an appointment?

A.C.

Hi, Susan. You do not have to make an appointment to come in to our offices, but with an appointment, you will be helped before our walk-in customers. You can schedule an appointment with your local office by calling us at 1-800-772-1213 between 7:00 a.m. to 7:00 p.m., Monday through Friday, and a representative will assist you. In most cases, you can handle your business by phone. We hope this helps.

Bob C.

what month can you collect social security benefits at 116% after turning age 68 in May?

dennis b.

the online application for retirement will not let me sign or submit! it keeps going to summary but everything is checked green with no errors. i have been trying to submit since jan 2019! can someone call me to correct? 520-401-2261

Steve A.

How do you withhold taxes on social security payments.

A.C.

Hi, Steve. In order to have taxes withheld from your Social Security benefit, you must start by printing, completing and submitting an IRS Voluntary Withholding Request Form (Form W-4V). On this form, you can choose to have 7, 10, 12, or 22 percent of your monthly benefit withheld. The Form W-4V (to withhold federal taxes from your Social Security benefits) can be returned to your local Social Security office by mail or in person. See our Benefits Planner: Withholding Income Tax From Your Social Security Benefits web page for more information. We hope this helps.