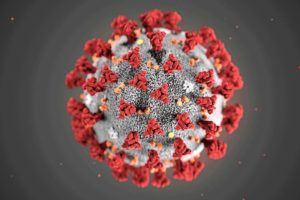

Coronavirus (COVID-19): Important Information about Social Security Services

Reading Time: 1 MinuteLast Updated: February 21, 2023

All local Social Security offices will be closed to the public for in-person service starting Tuesday, March 17, 2020. This decision protects the population we serve—older Americans and people with underlying medical conditions—and our employees during the Coronavirus (COVID-19) pandemic. However, we are still able to provide critical services.

All local Social Security offices will be closed to the public for in-person service starting Tuesday, March 17, 2020. This decision protects the population we serve—older Americans and people with underlying medical conditions—and our employees during the Coronavirus (COVID-19) pandemic. However, we are still able to provide critical services.

Please read our press release to learn more, including how to get help from the Social Security Administration by phone and online. You can also visit our website to learn more and stay up to date.

Please share this message with your friends and loved ones.

Did you find this Information helpful?

Tags: COVID-19, social security, Social Security benefits

See CommentsAbout the Author

Comments

Comments are closed.

Candace A.

PLEASE tell me is SSI recipients going to get stimulus money. Every news outlet has a different answer. I am so scared.

V.V.

We realize you have questions about possible economic stimulus payments, but this legislation has not yet become law. Please do not call us with related questions at this time. Subscribe and stay up to date with the latest Social Security information on Coronavirus (COVID-19).

wondering

I was married and filed taxes with my husband in 2018, but I am on SSI. (Divorced last year) Would my check go on my direct express card or would it arrive as one check under my ex-husbands name?

KEN W.

I receive S/S payments and work two days a week, a job I am about to be laid off from .I have not filled a tax return since 2011 as I have been under the IRS minimum amount to file. My question is my wife is not yet eligible for SSI and is not employed, we used to file jointly however we have no recent filing so how can she get the stimulus check ?

Thank you for your time KWW

Martin T.

KWW, That is a very good question. This is something that Social Security will outline when the bill has been passed. There are no current details about this as of this moment, what I would suggest is that you stay tuned until the bill has passed and then wait for Social Security to make an announcement on this matter. If there hasn’t been one, I would call in directly to their office and ask about it. I would assume that if you are married that she would be eligible under you because you have to report her income if she makes any as well as if she doesn’t. I don’t want you to get your hopes up, so please follow up with Social Security when they know these answers after the bill has passed and they have a direct answer for you. -Martin T

The O.

So let me ger this straight….I am 70 yo and if I can have some babies before the end of the year I can be eligible for 500 bucks more for each one.??? Any old ladies out there want to hook up?

Martin T.

I love the good humor in times of frustration and anxieties. It is needed. It was very funny and I bet you made some old lady laugh. Awesome comment. 🙂 -Martin T

Railfan4Trains

The pastor of our church will make a fortune, he has 11 children still living at home with him and his wife!

Justin F.

That 500 per kid, I believe only goes up to 3 children. So no, he won’t get 5500 for the 11 kids. no fing way

Anita S.

Dear Old Frog,

Um. You might have better luck with pre- menopause age ladies. Jus sayin

The O.

I would ask you to marry me Anita but I am not worthy, I have been with ladies in my lifetime and am no longer a virgin, you deserve better. I really wanted to give you the final rose (after I slept in the hot tub with 25 other nursing home hotties) but I am only looking for a nice lady to love honor obey (yeah sure) and cook of course. Where are the old fashion ladies of my yourh, I must keep looking. “If you do not where you are going, ALL the roads will get you there”.

TamilDhool H.

Great Content:

TamilDhoolHD!

Dawn

I dont know if there is any truth to this but here it says SSI recipients are included. Other then this site, it appears that people on SSI will not be included so I really do not know for sure.

https://www.forbes.com/sites/kellyphillipserb/2020/03/25/all-you-wanted-to-know-about-those-tax-stimulus-checks-but-were-afraid-to-ask/#7732c5db1f9c

Tom

They’re either misinformed or LYING.

Section 2201 of the Section By Section outline of the CARES Act (stimulus bill):

“Section 2201. 2020 recovery rebates for individualsAll U.S. residents with adjusted gross income up to $75,000 ($150,000 married), who are not a dependent of another taxpayer and have a work eligible social security number, are eligible for the full $1,200 ($2,400 married) rebate. In addition, they are eligible for an additional $500 per child. This is true even for those who have no income, as well as those whose income comes entirely from non-taxable means-tested benefit programs, such as SSI benefits.”

The last sentence contradicts FORBES, FORTUNE, ‘THE COLLEGE INVESTOR’, and the rest of the misinformation merchants.

Martin T.

Hey everyone, I hope the clutter in this blog clears out and people can get back to Q and A’s.

If you want a direct location of where it states it in the bill, please read pages 141-149 ‘SEC. 6428. 2020 and beyond. Specifically on page 149 reads as follows.

(‘‘(B) if the individual has not filed a tax return for such individual’s first taxable year beginning in 2018, use information with respect to such individual for calendar year 2019 pro-6 vided in ‘‘(i) Form SSA-1099, Social Security 8 Benefit Statement, or ‘‘(ii) Form RRB-1099, Social Security Equivalent Benefit Statement.”)

So people in this forum can stop scaring people on disability now. Thank you. Also, if you are on SSDI, SSI, make sure to check with Social Security after the bill passes to find out more information on if your spouse whom may not be working and didn’t pay taxes is “Eligible” under your your SSDI and/or SSI. Social Security has all of this information on hand because you report to them. Also make sure to check if you can claim 500$ per child that you may have. These payments sound to be 1,200 per person, $500 per child. I have not read anywhere about 200$ increase that was floating around.

Until the bill is passed on Friday and Social Security is made aware of all the information, don’t fret about it so much. Wait for Social Security to respond to your questions. Everyone has these questions and I hope I was able to answer to the best of my knowledge.

You can read the bill yourself as well as download it in PDF form. Source: https://www.npr.org/2020/03/25/820759545/read-2-trillion-coronavirus-relief-bill

Jerry

Just shows how dependency which we have created for ourselves as we have on the government which has turned some of our people into frightened wards of the state. To bring “RUDE” into the conversation shows that, even in our older ages, we expect to be pampered and have all of these great expectations from our government. I am tired of hearing all of this. Yes, there are some who would call this rude, but DEAL WITH IT, dont make such a BIG DEAL of it. We have lost the ability to fend for ourselves. This worrying about our “Old Age” should have taken place long before the age of 65. Just saying that complaining will get you nowhere, or if you do complain, you have had poor lessons taught to you. The military was a good place to learn this….hey, we are all in this together. What is worse, the Covid19 or getting your feelings hurt because you thought someone was rude. JJ

Chris B.

When will I receive my direct deposit from ssi I could care less about a stimulus I just want to pay my bills..? Is there a delay in payments? I just need to know

V.V.

Hi Chris. You will continue to receive your monthly benefit amount if you use Direct Deposit. For pay dates, check out our 2020 Schedule of Social Security Payments calendar. Subscribe and stay up to date with the latest Social Security information on Coronavirus (COVID-19).

Janet C.

WHAT A BUNCH OF DUMB ASS’S. GOING ON ABOUT RUDENESS. INSTEAD IF YOU CAN WITHOUT VENTING. JUST ANSWER THE QUESTIONS. ARE SSI & SSDI GETTING A STIMULUS IN THIS PACKAGE?

Arthur T.

Yes we are getting a check