White House Conference on Aging: What You Need to Know First About Enrolling in Medicare

Reading Time: 2 MinutesLast Updated: November 6, 2023

A healthy life is a good life. The Medicare benefits you’ve earned ensure that you can receive the care you need, when you need it.

A healthy life is a good life. The Medicare benefits you’ve earned ensure that you can receive the care you need, when you need it.

And, when it comes to Medicare benefits, the most important thing to remember is to apply for them at age 65.

On your behalf, advocacy groups asked us to place a greater emphasis on information about enrolling in Medicare at age 65, and specifically, about the potential problems that arise if you don’t.

In the past few months, in conjunction with the White House Conference on Aging, the Centers for Medicare & Medicaid Services (CMS) and the Social Security Administration have strengthened many of our communications products to ensure that all people nearing age 65 hear the following message:

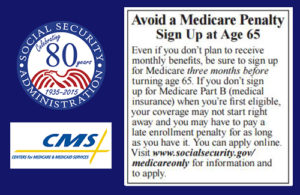

Three months before your 65th birthday, you should apply for Medicare benefits. At that time, you’ll be asked to elect if you also want Medicare Part B that helps pay for doctors’ services and many other medical services and supplies that hospital insurance doesn’t cover. If you don’t sign up at age 65, and you then decide to enroll later, you may pay a lifetime late enrollment penalty, and you may have a gap in medical insurance coverage. There are exceptions, but play it safe, and ask your Medicare or Social Security representative about your personal situation.

To make this message clear, our two agencies have already:

- Updated the text accompanying Medicare cards to emphasize the importance of enrolling in Part B when you’re first eligible, to avoid paying a penalty for as long as you have Medicare coverage.

- Updated publications about Medicare, such as the “Medicare” booklet and the “Apply Online For Medicare In Less Than 10 minutes—Even If You Are Not Ready to Retire” leaflet, to emphasize the importance of enrolling in Medicare when you’re first eligible.

- Updated frequently asked questions on Social Security’s and CMS’ websites, phone scripts, and training materials to better inform those who are newly eligible for Medicare.

- Updated the Social Security Statement and the insert for people who are 55 and older to strengthen the message about when to apply for Medicare. To get your Statement online, open a my Social Security account.

In the next few months, CMS will update their website and the Medicare initial enrollment period package; revise more Medicare publications; and add online resources for people who are still working.

Visit Medicare.gov to find out more about enrolling in Medicare. And, remember to apply online for Medicare three months before your 65th birthday!

Did you find this Information helpful?

About the Author

Comments

Comments are closed.

janet g.

I just turned 65. I did not sign up 3 months prior because of being confused. I am still working but want to sign up for part A now. please help. thanks

R.F.

Hi Janet. If you are 65 or older and not ready to start your monthly cash benefits yet, you can use our online retirement application to sign up for Medicare ONLY and apply for your retirement or spouses benefits later.

Bill

I’ve just applied for Medicare today 9-7-2016 when will I be in the program? When am I covered by Medicare, because I want to drop the horrible and expensive policy I have through ACA (Obama Care)? My birthdate is 10-15-1951.

J.Y.

Hello Bill. Your Medicare coverage will begin the first day of the month you turn 65. In your case, your coverage will begin on November 1, 2016. Thanks for asking!

Judy

MONTICULE | (12:24) BOTIKA VIEUX NA BISO YA MONTICULE. YE AU MOINS AZA VRAI OPPOSANT ! BA LUMBALA BAFINGA BINO BAZA KOLIA MBONGO PONA KOKENDE NA BA NGUNA PONA KOBOMA BA NDEKO NA BISO, BOSALAKA YE NINI ? AZA KOFANDA NA BINO AWA NA PARIS TRAENUILLQ. VIEUX NA BISO YA MONTICULE JEAN-CLAUDE VUEMBA TOZA SIMA NA YO. TIKA BA YUMA YA INTERNET BALOBA NDENGE BAMESANA.

John

My wife turned 65 in April and applied for Parts A and B in July, i.e. in the final month of her IEP. Now we understand that a decision may not be issued for several weeks. Would she be liable for a late enrollment penalty even though the application itself was submitted in time?

Jesse

I Have a Question.

Because I had what I thought was creditable Insurance, I went ten years with before signing up for Part B. Hence, I was slapped with a 100% penalty. In 2016, a year with out cola i was covered by The “No-Harm-Done ” Rule. But My Life long penalty of 100% went up to 116%.

Is this Legal?

D.B.

Thanks for your question, Jesse. The “hold harmless” provision protects most beneficiaries from a reduction in their monthly benefit, because of an increase in the Medicare Part B premium.

Generally, we increase a beneficiary’s premium for Part B by 10 percent for each full 12 months in which he or she could have been, but was not, enrolled in the program.

Due to the complexity of your situation, we recommend that you contact your local office or you can call our toll-free, 1-800-772-1213 (1-800-325-0778, if deaf or hard-of-hearing) for assistance.

Jeffry K.

I turned 65 in June. I am still working and do not receive Social Security. I did not apply for Medicare, because my wife and I receive health care benefits from my employer. My wife does not work and does receive Social Security. She turns 65 in August. Today we received a letter from the SSA Northeastern Program Service Center that they are starting Medicare Part A and Part B in August 2016 for my wife and starting this month they will deduct a monthly premium of $121.80 for the Part B. She is covered by my health insurance. I pay a substantial amount from each paycheck for this insurance for both of us. Why is SSA doing this? How do we stop this deduction?

D.B.

Hello Jeffry. Thanks for your question. When individuals are already receiving Social Security benefits when they reach age 65, we automatically enroll them into Medicare and mail them a Medicare card. If your wife wants to refuse coverage, she should follow the instructions on the Medicare card and return it in the enclosed envelope before the effective date.

Individuals with coverage under a group health plan from their own or a spouse’s current employment have a special enrollment period. During this “special enrollment period”, they can enroll in Medicare Part B. This means that they may delay enrolling in Medicare Part B without having to wait for a general enrollment period and paying the 10 percent premium surcharge for late enrollment. For more information, click here.

If your wife needs additional assistance, we recommend that she call our toll-free number, 1-800-772-1213, M-F between 7 AM and 7 PM and ask a representative to assist you, or she can contact your local office.

Jesse

Great Info: 12 Years too late for us.

Dropped /refused part B 10 years ago.

Never received this personal briefing or completed CMS-1763.

Now I’m doomed unless some action is taken to correct the ever increasing punitive nature of the Late Enrollment penalty . Even when The “No-Harm-Done” rule applies as in 2016, we who have been paying the penalty for the past few years suffered a reduction in our Social Security Benefit.

Wendy

Hi, I am currently under Medi-Cal (have been since 2014). I will be turning 65 on July 19th. I will not be eligible for Medicare benefit (in workforce less than 10 yrs) yet, but do I need to register/enroll this year just because I’ll be turning 65? or can I wait until I decide to retire?

This sentence is a bit confusing to me:

“If choose not to enroll in Medicare Part B and then decide to do so later, your coverage may be delayed and you may have to pay a higher monthly premium for as long as you have Part B.”

Any inputs will be appreciated. Thank you.

R.F.

Hi Wendy. Medicare is our country’s health insurance program for people age 65 or older. Generally, to qualify for Medicare, an individual will need 40 credits, or at least 10 years of work where Social Security taxes were deducted from their income. Anyone aged 65 or older who does not have 40 credits and therefore not insured, will have to pay premiums for both Medicare Part A & B. Individual can also qualify for Medicare on their spouse’s record if the spouse is insured, and age 62 or older. The California Medical Assistance Program or “MediCal” is California’s Medicaid program, serving low-income individuals. In some cases individuals can get help from their state to pay for Medicare related services. We suggest that you contact your local Medicaid office to inquiry about any Medicare savings program in your area.

arleen m.

we would like to know how we can cancel medicare program..its about to start next month and we will have to pay $194 a month and that is way too steep

R.F.

Hi Arleen, if you have limited income and resources, your state may help you pay for Part A and Part B. If you still need to terminate your Medicare Part B benefits, you must contact your local Social Security office. Our policy requires a personal interview be conducted with everyone who wants to terminate their Medicare Part B benefits, to be sure that you fully understand the consequences of doing so. Please call our toll free number at 1-800-772-1213 for further assistance. Representatives are available Monday through Friday, from 7 a.m. to 7 p.m. Thanks!

Otha D.

Helpful writing . I am thankful for the analysis ! Does anyone know if my business can access a fillable Rent or Lease Agreement example to type on ?

Michael E.

I am on SS Disabilty since March, 2016.

Am I currently 61 years old and am wondering if I am available for Medicare parts A, B and D.

I am using Cobra now from my last employer but it will expire in Feb. 2017, not to mention the $1500 a month it costs.

Can anyone give me advice, answers or directions I need to take?

It would be greatly appreciated.

R.F.

Hello Mr. Garner. Medicare is our country’s health insurance program for people age 65 or older. Certain people younger than age 65 can qualify for Medicare, too, including those who have disabilities and those who have permanent kidney failure. You will receive Medicare after you receive disability benefits for 24 months. We start counting the 24 months from the month you were entitled to receive disability, not the month when you received your first check. We hope this information helps.