White House Conference on Aging: What You Need to Know First About Enrolling in Medicare

Reading Time: 2 MinutesLast Updated: November 6, 2023

A healthy life is a good life. The Medicare benefits you’ve earned ensure that you can receive the care you need, when you need it.

A healthy life is a good life. The Medicare benefits you’ve earned ensure that you can receive the care you need, when you need it.

And, when it comes to Medicare benefits, the most important thing to remember is to apply for them at age 65.

On your behalf, advocacy groups asked us to place a greater emphasis on information about enrolling in Medicare at age 65, and specifically, about the potential problems that arise if you don’t.

In the past few months, in conjunction with the White House Conference on Aging, the Centers for Medicare & Medicaid Services (CMS) and the Social Security Administration have strengthened many of our communications products to ensure that all people nearing age 65 hear the following message:

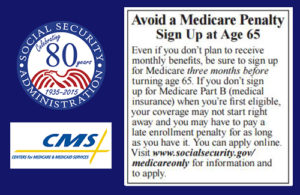

Three months before your 65th birthday, you should apply for Medicare benefits. At that time, you’ll be asked to elect if you also want Medicare Part B that helps pay for doctors’ services and many other medical services and supplies that hospital insurance doesn’t cover. If you don’t sign up at age 65, and you then decide to enroll later, you may pay a lifetime late enrollment penalty, and you may have a gap in medical insurance coverage. There are exceptions, but play it safe, and ask your Medicare or Social Security representative about your personal situation.

To make this message clear, our two agencies have already:

- Updated the text accompanying Medicare cards to emphasize the importance of enrolling in Part B when you’re first eligible, to avoid paying a penalty for as long as you have Medicare coverage.

- Updated publications about Medicare, such as the “Medicare” booklet and the “Apply Online For Medicare In Less Than 10 minutes—Even If You Are Not Ready to Retire” leaflet, to emphasize the importance of enrolling in Medicare when you’re first eligible.

- Updated frequently asked questions on Social Security’s and CMS’ websites, phone scripts, and training materials to better inform those who are newly eligible for Medicare.

- Updated the Social Security Statement and the insert for people who are 55 and older to strengthen the message about when to apply for Medicare. To get your Statement online, open a my Social Security account.

In the next few months, CMS will update their website and the Medicare initial enrollment period package; revise more Medicare publications; and add online resources for people who are still working.

Visit Medicare.gov to find out more about enrolling in Medicare. And, remember to apply online for Medicare three months before your 65th birthday!

Did you find this Information helpful?

About the Author

Comments

Comments are closed.

R. J.

Your telephone answering recording (lady); initially says: “All of our telephone reps., are “currently” assisting other people…(or similar). Well, I must advise you, same as 80-90% of other companies/agencies etc. using same phrasing.The word currently is REDUNDANT. (E.g. Unnecessary) same as current; as both are, 98% of the time when used our language. (Try it, & see) More e.g.) “The current temperature is..” (Wrong!) “The temperature is.” “I am currently working at…” (Wrong!) There are thousands more. Challenge, try to come up with a correct use of that word. I just did to give U one, & cud not. Ha! Respectfully.

elaine g.

My 65th . birthday is in sept why am I being put on social security on April 1. I also get ma health standard now I have to pay. $134 a month for insurance. I am currently disabled.

STEVE G.

My wife is 71 years old and is a 2-year Legal Permanent Resident (LPR) by virtue of our marriage in June 2015. She came to the USA on a Fiancee visa. She is not eligible for Medicare. I was able to get her included in my CalPERS-sponsored group health plan as my dependent soon after our marriage in 2015 and also 2016. Unfortunately my former employer cancelled its contract with CalPERS, so I had to switch to another group plan sponsored by my employer, the City of Upland. During the open enrolment, I was informed that my wife must enroll in Medicare Parts A & B to qualify for the lower, more affordable heath insurance premium. With CalPERS, I was paying $841 per month for a KP-HMO; under the new group I am being billed $1,581.44. To qualify for the lower rate, I was told she must enroll in Medicare Part A and B.

How do I go about enrolling or buying Part A an B from Medicare. I was told I have until March 31, 2017 to enroll. Does the penalty provisions for late enrolment apply in her situation, since she did not work nor had gainful employment in the US?

R.F.

Thank you for contacting us Steve. Individuals have a chance to sign up for Medicare benefits during a “general enrollment period” from January 1 through March 31. An eligible (non-U.S. citizen) spouse must meet the following requirement:

• He or she must have resided in the U.S. for 5 or more years, and

• He or she must have been in a spousal relationship with the person on whose earnings record the entitlement is based for 5 or more years.

We recommend that you continue working with your local Social Security office for specifics in your situation. We also suggest that you share the information we provide you with your personnel office, check with your health benefits advisor, or health plan representative for more guidance and information about this matter.

Amanda R.

Thank you for your quick response.

Amanda R.

Can you tell me if the “hold harmless” provision regarding Medicare Part B premiums will apply to me? I’m a CSRS annuitant who will be 65 next year. I will not be insured for SSA at that time, but am working toward insured status. The SS check will be the minimum, so it won’t cover the entire Part B premium. Thank you!

R.F.

Thank you for your question Amanda. The “hold harmless” provision protects approximately 70 percent of Social Security beneficiaries from paying a higher Part B premium, in order to avoid reducing their net Social Security benefit. Generally, the “hold harmless” provision does not apply to federal retirees covered by the Civil Service Retirement System (CSRS) who do not receive Social Security (or do not receive large enough Social Security payments to pay Part B premiums from their Social Security checks). This group also includes state government retirees not covered fully by Social Security. Please call our toll free number at 1-800-772-1213 and speak to one of our representatives for further assistance. Representatives are available Monday through Friday, between 7 a.m. and 7 p.m. Thanks.

Frank V.

I find it appalling that the 2 most important items that aging people face are not even covered by Medicare. The two are hearing and dental. I feel for people that don’t have the extra coverage to take care of these.

Nayyar

In order to take part in employer offered (Health Savings Account) HSA, do I need to terminate my Medicare PART A (Hospital Insurance).

R.F.

We suggest that you speak with the employer’s health benefits advisor, or health plan representative about this matter. Please visit the Medicare website to learn about other programs available outside of the traditional Medicare program.

Amanda R.

Can you tell me if the “hold harmless” provision regarding Medicare Part B premiums will apply to me? I’m a CSRS annuitant who will be 65 next year. I will not be insured for SSA at that time, but am working toward insured status. The SS check will be the minimum, so it won’t cover the entire Part B premium. Thank you!

Leslie S.

I am turning 65 at the end of this year (2016). I am still employed full time and receiving health care coverage. I also have an HSA. It’s my understanding the HSA will have to be absolved if I enroll in Medicare. What are my options….do I have any and can I wait to enroll in Medicare when I retire? Will I be penalized if I do not enroll in Medicare now during my enrollment period?

Thank you

R.F.

Hi Leslie. If you are actively working and covered under your employer’s group health insurance program, you can delay enrollment into Medicare Part B until you stop working or the health coverage is dropped. However, we suggest that individuals speak to their health benefits advisor, or health plan representative to see what’s best for them, and to prevent any penalties or delayed enrollment in the future. To learn more about the Medicare enrollment periods visit http://www.Medicare.gov. For specific questions about your case, call 1-800-772-1213, M-F between 7 a.m. and 7 p.m. and ask a representative to assist you, or you can contact your local office directly. Also, if you are 65 or older and not ready to start your monthly cash benefits yet, you can use our online retirement application to sign up for Medicare ONLY (Part A) and apply for your retirement benefits later. We hope this helps!

Tina G.

I was deemed disabled because of my COPD in Nov of 2014. I have not rec’d any information re: my Medicare. Since I have to have coverage And insurance I need to know who to contact. I am on the phone at this time and have been waiting for 40 minutes as I type this,,,,HELP!!!!!!!!

TERRY

I am 67 (still employed and covered by a health plan of an employer with more than 50 employees) and have signed up for Medicare which makes me no longer illegible to fund my HSA. I recently see that currently you may decline the Medicare coverage and continue to fund an HSA until retiring. Am I able to decline medicare now and be able to fund my HSA and rejoin medicare later without penalty???

R.F.

Thank you for your question Terry. Generally, if you or your spouse are still working and are covered under a group health plan based on that employment, you don’t need Medicare part B until you stop working or drop your health care coverage. However, we always suggest that individuals speak to their personnel office, health benefits advisor, or health plan representative to see what’s best for them, and to prevent any penalties or delayed enrollment in the future. To learn more about the Medicare enrollment periods visit http://www.Medicare.gov. For specific questions about your case, call 1-800-772-1213, M-F between 7 a.m. and 7 p.m. and ask a representative to assist you, or you can contact your local office directly. Hope this helps!