White House Conference on Aging: What You Need to Know First About Enrolling in Medicare

Reading Time: 2 MinutesLast Updated: November 6, 2023

A healthy life is a good life. The Medicare benefits you’ve earned ensure that you can receive the care you need, when you need it.

A healthy life is a good life. The Medicare benefits you’ve earned ensure that you can receive the care you need, when you need it.

And, when it comes to Medicare benefits, the most important thing to remember is to apply for them at age 65.

On your behalf, advocacy groups asked us to place a greater emphasis on information about enrolling in Medicare at age 65, and specifically, about the potential problems that arise if you don’t.

In the past few months, in conjunction with the White House Conference on Aging, the Centers for Medicare & Medicaid Services (CMS) and the Social Security Administration have strengthened many of our communications products to ensure that all people nearing age 65 hear the following message:

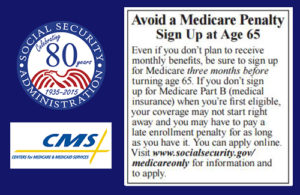

Three months before your 65th birthday, you should apply for Medicare benefits. At that time, you’ll be asked to elect if you also want Medicare Part B that helps pay for doctors’ services and many other medical services and supplies that hospital insurance doesn’t cover. If you don’t sign up at age 65, and you then decide to enroll later, you may pay a lifetime late enrollment penalty, and you may have a gap in medical insurance coverage. There are exceptions, but play it safe, and ask your Medicare or Social Security representative about your personal situation.

To make this message clear, our two agencies have already:

- Updated the text accompanying Medicare cards to emphasize the importance of enrolling in Part B when you’re first eligible, to avoid paying a penalty for as long as you have Medicare coverage.

- Updated publications about Medicare, such as the “Medicare” booklet and the “Apply Online For Medicare In Less Than 10 minutes—Even If You Are Not Ready to Retire” leaflet, to emphasize the importance of enrolling in Medicare when you’re first eligible.

- Updated frequently asked questions on Social Security’s and CMS’ websites, phone scripts, and training materials to better inform those who are newly eligible for Medicare.

- Updated the Social Security Statement and the insert for people who are 55 and older to strengthen the message about when to apply for Medicare. To get your Statement online, open a my Social Security account.

In the next few months, CMS will update their website and the Medicare initial enrollment period package; revise more Medicare publications; and add online resources for people who are still working.

Visit Medicare.gov to find out more about enrolling in Medicare. And, remember to apply online for Medicare three months before your 65th birthday!

Did you find this Information helpful?

About the Author

Comments

Comments are closed.

Larry

I turned 65 in March 2015 and was enrolled in Medicare Parts A and B. I am also covered by my wife’s health insurance and I also have Tricare for Life. Do I need to keep Medicare Part B? If not how do I cancel it? Will it affect my Tricare for Life?

Ray F.

Good questions Larry! Generally, individuals can decline or delay enrollment into Medicare Part B when covered under an employer’s group health insurance coverage. However, current law requires TRICARE beneficiaries who are entitled to Medicare Part A to enroll in Medicare Part B to retain their TRICARE benefits. Please visit the TRICARE web page or contact the Department of Defense or a military health benefits advisor for more information.

Mikel

Surrnisipgly well-written and informative for a free online article.

Jan

I will be 65 in January, and have been receiving Social Security retirement benefits for a few years. I enrolled in the exchange when it started, and have been paying $10 a month. I received the packet a few weeks ago, part B will cost me $125 per month. Seriously, if I am now poor enough to pay $10 a month, why will turning 65 suddenly make me wealthy enough to pay $115 more? Is there no way to keep what I have?

pat

I work for a school system that does not participate in social security. some of my teachers fall under the program that if you were hired before 1986 and never left our employ you were exempt from medicare. Now they are trying to access medicare in order to keep their insurance but are told they have not paid any in. Is this true? How can we fix this so they can acess medicare?

Ray F.

Hi Pat! Unlike workers in the private sector, not all state and local employees are covered by Social Security. Some are covered only by their public retirement pension program; some are covered by both public pensions and Social Security; and some are covered by Social Security only. Each state has a State Social Security Administrator who can provide additional information about Social Security and Medicare coverage. Please read our publication “How State And Local Government Employees Are Covered By Social Security And Medicare” for more information.

sylvia

Am so confused.., not sure if I need to sign up now for extra medicare or medicap plan.

Early this yr, my position was eliminated & I was laid off. Unable to find another job, worried about my bills, so I decided to sign up for early ss benefits. I will turn 65 end of Nov & my 1st medicare part b payt will be deducted from my

Nov ss check.

Thankful, I only need to take pill for my underactive thyroid. I have many bills to pay from unsuccessful business so cannot afford to pay for extra coverage w/ss ck

I hope to be able to find.another job soon & maybe in a couple yrs to sign up for drug or medicap coverage.

But, I heard I may have to pay more later if I don’t sign up now for suppl coverage.

Please.., does anyone know if that is true?

Richard A.

When I approached 65 I signed up for Medicare Part A even though I was still employed full-time. As I neared retirement I signed up for Part B, supplemental medical insurance (Aetna), and drug coverage (Humana). Aetna and Humana both sent me “Welcome” packages and an I.D. number with wallet card. Fast-forward eight months and I call Humana to find out how to process my first prescription since joining only to be told that my coverage began December 1, 2014 and was cancelled the same day because Medicare said I was ineligible. No one, however, thought it necessary to notify me. Several weeks of phone calls from myself and my insurance agent have resulted in Humana pointing the finger at Medicare, and Medicare telling us they never said to deny me coverage. Humana can’t identify any letter, email, or phone reference number from Medicare that would support their claim but stand by their processing code number that says it was denied because of direction from Medicare. Medicare said they have no record of advising Humana to deny my coverage and that there would have been no reason to have done so, but since I don’t have coverage I can’t enroll again until October “open enrollment” to take effect January 1, 2016 and must pay a lifetime penalty for failure to enroll when I retired. It’s a bit frustrating when I have proof that I did enroll in a timely manner, but have to pay the penalty because of gross incompetence/lack of record keeping for Humana, and possibly Medicare too. What does it take to get honest answers from either of the two mega-agencies responsible for this problem???? Did I mention that neither agency notified me of the cancellation or reason, and that I was issued an I.D. number (Yes, I think I did).

Ray F.

We are sorry to hear about your situation in regards to having to pay a penalty for late enrollment, and can understand your frustration.

If you have proof to support that your initial enrollment happened timely, you need to contact Medicare and request an appeal. You can request an appeal if Medicare or your plan stops providing or paying for all or part of a health care service. We hope this information is helpful.

Clara

Good website! I truly love how it is simple on my eyes and the data are well written. I am wondering how I could be notified whenever a new post has been made. I have surbscibed to your RSS which must do the trick! Have a great day!

Ray F.

Thank you for subscribing Clara, we appreciate your support!

G.w.

I do not see any current blogs. Is this site still active?

paul b.

an old ex government employee I know a little about red tape I have ssi and social security and so does my youngest son he is disabled learning dissabality.am I reading between the lines is all this going to end after this year or what I can remember what our late president did in the past but that I know is gone I have helped my Children And tried to teach them wright from wrong.

Ann

I am a Federal govt employee and will still be working when I turn 65. I know I don’t have to enroll in part B until after I retire, but what about Part D? Can I wait to sign up for Part D until I sign up for Part B without a penalty?

Ray F.

Good question Ann! Anyone who has Medicare hospital insurance (Part A), medical insurance (Part B), or a Medicare Advantage plan (Part C) is eligible for prescription drug coverage (Medicare Part D). Joining a Medicare prescription drug plan is voluntary, and you would pay an additional monthly premium for the coverage. As with Part B enrollment, you will not be penalized to enroll in Medicare Part D after age 65, as long as you are covered under an employer’s group health insurance program. For more information and to understand more about Medicare Part D enrollment periods, visit http://www.Medicare.gov.

John

Why haven’t you answered my question that I posted on 13 July at 11:35 am?

Mari W.

Des Part A & B give you dental & glasses or do you have to have part C for that.

Lorenzo D.

Hi Mari, and thank you for using our blog. Check out What Medicare covers, or for additional information, visit the Medicare web site.

Susan S.

Where is a good source of information for finding out and deciding whether to keep my employer’s insurance plan as supplemental/secondary after my retirement? Is there a difference between supplemental and secondary, and if so what is it?

Lorenzo D.

Susan, here are some links to some information that may help you: What Medicare covers, Supplements and other insurance and How Medicare works with other insurance. We also suggest that you request information from the health benefits office at your job to find out how your employer’s plan would work with Medicare if you decide to keep it after you retire.