Getting Two SSI Payments in One Month

Reading Time: 2 MinutesLast Updated: April 18, 2025

For most months in the year, Supplemental Security Income (SSI) recipients get their SSI payment on the first day of the month. But when the first day of the month falls on the weekend or a Federal holiday, you receive your SSI payment on the last business day before the first day of the month. That means you may get two SSI payments in the same month.

For most months in the year, Supplemental Security Income (SSI) recipients get their SSI payment on the first day of the month. But when the first day of the month falls on the weekend or a Federal holiday, you receive your SSI payment on the last business day before the first day of the month. That means you may get two SSI payments in the same month.

We do this to avoid putting you at a financial disadvantage and make sure that you don’t have to wait beyond the first of the month to get your payment. It does not mean that you are receiving a duplicate payment in the previous month, so you do not need to contact us to report the second payment.

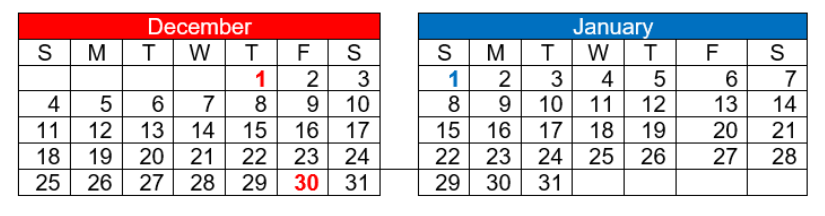

Below is an example of how this will work in January 2023. January 1, 2023 is the Federal holiday of New Year’s Day (it also happens to be a Sunday), so we will not issue your payment on January 1. Since December 31 is a Saturday—and we don’t issue a payment on a weekend—we will issue your SSI payment for the month of January on December 30, 2022. In this example, you get two SSI payments in December.

The first December payment, on December 1, is your regularly scheduled payment for December. The second December payment, on December 30, 2022, is your SSI payment for the month of January. You will not get an SSI payment in January because you received it in December.

On our website, we provide a Schedule of Social Security Benefit Payments for the current and upcoming calendar year.

Securing today and tomorrow starts with being informed. Please share this information with your friends and family—and post it on social media.

Did you find this Information helpful?

Tags: SSI, supplemental security income

See CommentsAbout the Author

Comments

Comments are closed.

Valerie

No mention was made as to which tax year the 2nd December payment would be attributed to:

2022 or 2023?

Marcia J.

If December 1 payment is for December 2022, and January is the next month, then it would be 2023.

Lyquinta F.

Payment

Daniel

The lobotomous snowman@gmail.com

Leevon G.

How much the second check will be.

Tammy

The 2nd SSI check is technically your January payment. Therefore, the amount will be your regular payment amount. However, there was a raise for 2023 so you will receive the new amount every month.

Mario Z.

Ustedes se refieren si recibo $1000.00 un cheque viene el primero de cada mes son $500. y el otro al final que son $500.00. . La pregunta es cual es la razón.

A.C.

Hi, Mario. For information in Spanish, please visit us at http://www.segurosocial.gov, http://www.facebook.com/segurosocial, or http://www.twitter/segurosocial. For Social Security information in other languages, please visit us at http://www.ssa.gov/multilanguage. Thanks!

Elaine K.

I have always gotten my SS check on the fourth Wednesday of every month

How will this change as I am confused

Gloria D.

How do that work for people who get paid on the 3rd and 4th Wednesday ?

Tony

If you are getting payment on the 3rd or 4th Wednesday, then you are receiving Social Security Retirement (SSR) or Social Security Disability Insurance (SSDI). It is not SSI. SSI is non-taxable (tax-free) money. The SSA won’t send the SSI beneficiaries a SSA 1099 form.

If you look carefully at the 2022 payment schedule, then you will see that you are not receiving SSI.

Some people on SSI can buy their booze and cigarettes early and don’t have to wait until January 1. They can’t buy it with food stamps.

Sheila

That reply was totally uncalled for in my book!

Saying some people on SSI, and they can’t buy it with food stamps!

Senior citizens have a hard enough time trying to pay their bills after working all their lives, and now not getting anything in their checks to have someone like you to come along saying something like that! Most of them can’t even get food stamps because they get just a couple of dollars too much to qualify! So they usually have to let a bill go just to be able to eat one month! And what do you do? You sit up and bad mouth people you don’t even know! You judge just because of 1 or 2 people!

Well I’m here to tell you that it’s not your place to judge, only GOD’S, and I truly hope and pray that he is very lenient with you when your time comes! I hope you don’t have to face hunger like elder people do, and then go and sit in food lines just to get molded bread and out dated food that could possibly make you sick enough to die!

Tony

I didn’t say all people on SSI. The SNAP program has a fraud holine. The SSA has a CDI Unit to handle fraud. These things happen. We just can’t pretend they don’t exist.

You think the government care that they made a few dollars more and cannot get food stamp. That is why the government passed the law. They also pass the law where you cannot buy booze and cigarettes with food stamps.

The U.S. currency is minted with the phrase “In God We Trust.” They can’t go around stealing U.S. taxpayers money. You are allowing the devil’s work to continue.

Sheila

And for your information, some if not all SSID is not taxable, depending on how much you get a month!

For the most part, most people don’t get enough and after years of not being able to pay anything but minor bills.

That’s one of the reasons SSA started this ticket to work to help people try and get back on their feet, or at least supplement their income by working a few hours a day!

By paying taxes back it also increases their checks after a while, if they’re not able to withstand the job because of their disability, the ticket to work can always try to find them something else.

So if you’re one of these people who think that people on disability or SSI or whatever is taking money out of your pocket, STOP! Because they worked for that money for the most part a long time before you, if they are seniors or maybe even children who have lost a parent and drawing off one, or even both; wouldn’t that just be so sad?

We never know what someone’s situation is, so that’s why we never say things like you did!

I hope you have the most AWESOME Day, and just know that GOD, and we all love you very much. (:

Tammy

>>>”Some people on SSI can buy their booze and cigarettes early and don’t have to wait until January 1. They can’t buy it with food stamps.”<<<

Pretty disgusting comment.

Are you upset that you can't buy your booze and cigarettes before the 1st‽

Roy ..

How do I get the final results on my application for Deemed Filing?

A.C.

Hi, Roy. Thanks for visiting our blog. For your security, we do not have access to private information in this venue. We ask that members in our Blog community work with our offices with specific questions. You can call us at 1-800-772-1213, Monday through Friday, between 8:00 a.m. and 7:00 p.m., for assistance. You can also contact your local Social Security office. We hope this helps.

majed m.

How do I get help accessing my Social Security number?

Tammy

Call the Social Security office.

majed m.

How do I get Messi from outside America?

A.C.

Hi, Majed. Thanks for visiting our blog. Since you are living outside of the U.S., please contact your local Federal Benefits Unit for any assistance related to Social Security benefits. Also, our Office of International Operations home page provides more information to assist our customers living abroad. We hope this helps.

Bobbi C.

I know this may not be the place for this comment, but I continually have trouble logging into my SSA account online. My username and password are saved, but it continues to not accept my sign in and then blocks me for 24 hours of trying again!

I don’t understand why this happens!!

I would hope that SSA could give users like me an easier option, because we know calling is very time consuming.

Cornell H.

They do me the same damm way.

Will J.

Amen!

Tammy

Same issue and it is annoying as h…!

KathyD

My SS comes the second WED of every month. This December the 1st fell on Thursday so I won’t receive until the 14th. This has happened a couple of times. It has been a financial challenge these times. Is it possible to change receiving date?

Rozell

This is a good question I wish they would respond to you.

Eloise T.

I agree this a problem hope they answer this question

Bev

I know. Waiting until the 14th is a struggle.

A.C.

Hi, Kathy. Thanks for visiting our blog. No, you cannot change it. It is based on the birthday of the person on whose record you receive benefits. Thanks.

Gail J.

Good morning,

I have a question for SSA, I received a text stating that there was important information about mine online account. Also they gave me a security code along with the text. Now, I log into my security and don’t see where the text came from nor, do I not see where to put the security code at. Frustrating, I longed on so many times to see if I missed something but, no!

Can you help?

A.C.

Hi, Gail. For your security, we do not have access to private information in this venue. We ask that members in our Blog community work with our offices with specific questions. You can call us at 1-800-772-1213, Monday through Friday, between 8:00 a.m. and 7:00 p.m., for assistance. You can also contact your local Social Security office. We hope this helps.

Lawrence R.

My wife and I have been married for 7 years. The first year I submitted a married Head of Household Income Tax report it was denied because her new married name did not match with her Social Security number. What must I do, or who do I contact, to change her married name to associate with her Social Security number?

A.C.

Hi, Lawrence. Thanks for visiting our blog. In order for your wife to change her name on her Social Security card, she must show us a document that proves her legal name change. If the document she provides as evidence of a legal name change does not give us enough information to identify her in our records, she must show us an identity document in her old name (as shown in our records). We offer the option for her to mail her completed application with original or certified documents to her local Social Security office. For more information about how and what to submit, visit our Frequently Asked Questions. We hope this helps.

William L.

Seeing comments that some get their SS on the First and others on the 14th. How about a dual payment, splitting the monthly amount into 2 equal payments, and distribute on the first and third Friday of every month? Where Fridays are a holiday, move up one day to distribute on Thursday, for that week. This way payments can be expected without concern.

Joe Q.

So your solution to the 70 million payments that the treasury department has to send out each month is to split them and make 140 million deposits instead??? How about learning to budget and call it a month. Self help instead of throwing a wrench in the payment system.