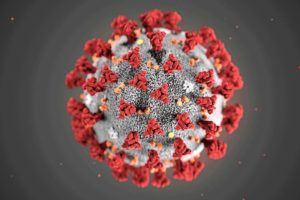

Coronavirus (COVID-19): Important Information about Social Security Services

Reading Time: 1 MinuteLast Updated: February 21, 2023

All local Social Security offices will be closed to the public for in-person service starting Tuesday, March 17, 2020. This decision protects the population we serve—older Americans and people with underlying medical conditions—and our employees during the Coronavirus (COVID-19) pandemic. However, we are still able to provide critical services.

All local Social Security offices will be closed to the public for in-person service starting Tuesday, March 17, 2020. This decision protects the population we serve—older Americans and people with underlying medical conditions—and our employees during the Coronavirus (COVID-19) pandemic. However, we are still able to provide critical services.

Please read our press release to learn more, including how to get help from the Social Security Administration by phone and online. You can also visit our website to learn more and stay up to date.

Please share this message with your friends and loved ones.

Did you find this Information helpful?

Tags: COVID-19, social security, Social Security benefits

See CommentsAbout the Author

Comments

Comments are closed.

Terri J.

I can’t find anything about this online but how do you report underemployment to SSI? And does it affect your payments as a payee for your child? My son gets SSI and I’m still working but my hours have reduced and today was my first payment from unemployment as well. So how would I report the two next month?

V.V.

Hi Terri, thank you for your question. For Supplemental Security Income (SSI) recipients, you need to report all of your income, including unearned income such as unemployment. Please note that we will not consider economic impact payments as income for SSI recipients, and the payments are excluded from resources for 12 months.

For more about reporting income, check out the online booklet, Understanding Supplemental Security Income. To report your income, you can call us at 1-800-772-1213 (TTY 1-800-325-0778) or your local Social Security office. Please look for the general inquiry telephone number at the Social Security Office Locator. The number may appear under Show Additional Office Information. Please be aware that our call wait times are longer than normal. We hope this information helps.

arthur k.

And how long would take for me to get my check

Jerry W.

I’m on social security can tell me when I’ll get my stimulus check or how I go about getting it

arthur k.

aothurking4174@gmail.com

David D.

I’m on SSDI and my mother is on SSI, we both have not received anything.

Noreen J.

Sir I’m on ssi wen am I supposed to receive the money

Helen J.

How does the stinulus check work for payee..My husband gave me well over 25 years ago due from is TBI.

U

Shoshana zadok s.s#xxxxxxxxx l started to get benefits Lin apr 3,20 I understand that citizen living in ISRAEL entitled to corona virus stimulus check, when should expect the payment

j

No because we hate Israel.

Diana

Not a we and your a creep saying that. We? Got a rat in that pocket. Creep.

Roberto

I think he was making fun because who would post a SSN…it’s a fake post.

Pab

No he’s anti-Semitic. He hates anyone Jewish.

Pab

PLEASE REMOVE YOUR SSN. THAT’S S TERRIBLE IDEA AND YOU NEVER EVER TELL ANYONE YOUR SSN.

Jeanette K.

I am on social security. My ss# is xxxxxxxxx. I have not received my corona check. I am also raising my two grandchildren. Clemit and Lilly Keiper. I have not received checks for them. Could you please direct me what I need to do. I am 83 years old. And I need assistance with this

Respectfully

Jeanette Keiper

Keiperstire@aol.com. 570 401 2035

Pab

WHAT THE HECK ARE YOU THINKING? YOU PUT YOUR LEGAL NAME AND SSN ON THE INTERNET FOR ALL TO SEE. WOW. WHAT A COMPLETE DUNCUFF. LMAO.

Kimberly B.

I’m on social security and I haven’t received my stimulus money

Danny T.

Yes I am a 43 year old citizen of these suppose United States, I have been on this program since I was 16 years old, I have suffered with depression, most of my adult life. I have worked on more than enough jobs. Momentarily, but I have worked. I have been in and out of jail for various mild disputes, over like half my life. In between those times, I had those jobs. Today, by the mercy and grace of our GOD; I can say “it’s been almost 8 years since I’ve been in prison. But, over the years from working I have paid the SSI program any overpaid moneys. So since I cannot work unless it’s under 20 hours a week, actually certain amount of money. So I decided to allow someone to use me as a dependent, it is a relative. In order to get a few extra dollars this year. I have AN ADDRESS PAY RENT PAY INTERNET PAY UTILITIES, that are all in my name. When I worked I paid taxes to Social Security and even paid SSI as well for over 15 years out of my SSI $77 a month. I REFUSE TO ALLOW TREASURY OF STATE TO DEEM ME AND MANY OTHER AMERICANS IN MY SITUATION NOT ELIGIBLE TO OUR ENTITLEMENT. I don’t know what’s going on, but , it is not FAIR!

Libby S.

Well, my mother who is 88 and has worked for 50 years (more than 40 hours per week) GETS NOTHING because she lives with me. I listed her on my taxes which only enabled me to file as head of household, nothing more. Now, that is UNFAIR!! She worked all her life, never missed work, paid into the system, never in jail or anything like that. Always a good employee with a large corporation. And this is how we take care of the elderly.

Pab

LMAO. You’re screwed and rightly so because what you did was fraudulent. #SorryNotSorry. Also, like a true criminal, you blame everyone else but yourself for your crummy choices.