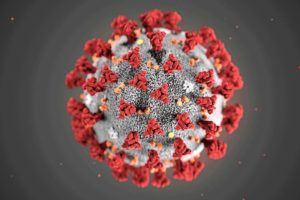

Coronavirus (COVID-19): Important Information about Social Security Services

Reading Time: 1 MinuteLast Updated: February 21, 2023

All local Social Security offices will be closed to the public for in-person service starting Tuesday, March 17, 2020. This decision protects the population we serve—older Americans and people with underlying medical conditions—and our employees during the Coronavirus (COVID-19) pandemic. However, we are still able to provide critical services.

All local Social Security offices will be closed to the public for in-person service starting Tuesday, March 17, 2020. This decision protects the population we serve—older Americans and people with underlying medical conditions—and our employees during the Coronavirus (COVID-19) pandemic. However, we are still able to provide critical services.

Please read our press release to learn more, including how to get help from the Social Security Administration by phone and online. You can also visit our website to learn more and stay up to date.

Please share this message with your friends and loved ones.

Did you find this Information helpful?

Tags: COVID-19, social security, Social Security benefits

See CommentsAbout the Author

Comments

Comments are closed.

Mary A.

Social Security is my only income, and it is little enough that I do not file taxes, nor pay them. Seems people in this position need the stimulus as much or more as anyone else. When will we know if Social Security recipients will receive any of this? Thank you for any knowledgeable response.

Never M.

Pretty much every other source I am finding says

“Taxpayers with little or no income tax liability, but at least $2,500 of qualifying income, would be eligible for a minimum rebate check of $600 ($1,200 married). ”

Looks like those of us on SSI are SOL. Good luck, and enjoy the extra struggle I guess.

catherine

It means those on SS/SSI will get half of what everyone else gets and those other people who didn’t make enough to pay taxes which is A LOT of low wage PT workers will get less too. And this is COMPLETE bullshit. Low wage workers are the ones out of work now. And they get less??? Anyway that is being disputed Mitt Rommey is against it.

wanda w.

Cash payments of up to $1,200 would go to individuals, with up to $2,400 for couples. The sum would increase by $500 for every child. The check totals would start to phase out above $75,000 in adjusted gross income based on 2018 tax returns. People with no federal tax liability would get only $600.

Poor G.

Thanks. $600 is better than nothing atleast if this is the plan they go with.

Lildarlin

Kari,..Cash payments of up to $1,200 would go to individuals, with up to $2,400 for couples. The sum would increase by $500 for every child. The check totals would start to phase out above $75,000 in adjusted gross income based on 2018 tax returns. People with no federal tax liability would get only $600.

Robert C.

How about someone on ssi/disability?

Kari

Some is better than none.

Lildarlin

it’s in print… I too could have used the 1000,.but I’m grateful for the 600 because i had no tax liability due to SSDI.

Joel B.

So either we get screwed either out of 1/2 the minimum or all of it altogether. Thanks Trump.

Poor G.

Try not to be ungrateful. Times are hard but right now were not exactly paying into the pot.

Crab

i Used to pay into that “Pot”

thank t.

well now you get the full amount

Nila

HILARIOUS to say the least. Rude vs Not rude. All I have to say is that I hope the hell none of you are running or plan on running for any political seats. I am praying hard..and I don’t pray……much.

U.S. T.

Short answer: Everyone will be receiving a check, if income level is less than $75k. It’s not about working, or not, it’s about stimulating our economy. Visiting local restaurants & shops who are struggling.

$1200 per person. $500 per child. Checks will be available on or before April 13th, 2nd round will be May 17th.

In the last recession, checks went out to pretty much everyone who wasn’t a millionaire and filed a U.S. tax return, including Social Security recipients. Americans earning at least some income but less than $75,000 got the full amount, while wealthier people got less. The payments were sent by a check in the mail or direct deposit into a bank account.

The Internal Revenue Service has many people’s direct-deposit information, given that close to 90 percent of people filed their tax returns online last year. Money could be delivered even faster to a lot of the hardest-hit people if it were sent via Social Security payments to the elderly or via the Electronic Benefit Transfer debit cards that government aid recipients already have.

Don’t worry, everyone!

Peace & Love

David

The check are being sent out the 6th for a 1000 not 1200.Only for tax payers.People on ssi ssdi n social security arent getting anything.

Clinton B.

Are you a verified representative of the US Treasury?

warren t.

https://nypost.com/2020/03/19/gop-coronavirus-stimulus-bill-unveils-1200-checks-for-public/

Jason A.

Hello I apologize for some of the other peoples rudeness on this topic , fear makes some people do stupid things , toilet paper hoarding for example , panic .. Anywho my question is I am on Disability , will I be included in the Stimulus program being discussed on the house floor ?

Thank you for your time and have a lovely day

michael

Just settle down. Just the tax payers are getting this money.the rest of you piss off. You get shit

Jason A.

You dont know that

bobbi s.

Make America Hate Again.

Nila

Michael ..Lol lol…too funny

Mirjana H.

Im permanent residnent in USA and my income is 250.00$ a month.This is my retriment from my country.

Will I receive a stimulus check, given that my retriment is extremely low

Dugan

I am now concerned , this is regarding the person who said they spoke to SS live and they said no, only working people.

Mae

Only if you file taxes. Those crooked ass holes.

J M.

I think no matter what is said by the government, we have to wait and SEE what it is exactly, that they will end up doing.

My thoughts on fixed income being included is this:

Those people may always have the same income coming in, but during these times, this actually could a problem. How so? My elderly mom, who worked her tail off in a machine shop for over 40 years, did not make enough money and when she retired after her stroke, she was able to get SSI with her SS. She has a “fixed income”. She used to manage so/so, but now a days, we are told to use home delivery (that costs) we are told that the delivery people are putting their life at risk by delivering, so they deserve bigger tips, and rightfully so (that COSTS), she doesn’t drive and relies on her elder bus service (her town bus is not free) or the locals that drive people to the stores for pay (that costs) and she cannot find what she needs in one store, so she has to go out to another (that costs). My mom, who is on fixed income, cannot afford the luxuries of deliveries, and in ordinary circumstances, tax payers would frown upon this. Wondering why a person on welfare is spending that money on deliveries and such. Well, because she has little choice. The government prefers that, and wants people to stay home. She is also at very high risk of death, if she catches this virus. 74 year old woman,A-fib, type 2 diabetes, history of stroke, and many physical damages from work. That she never sought out any type of payment for or even complained, by the way.

So YES, the fixed income individuals certainly deserve help during this trying time. And no, they should not have to pay taxes on it later. The government is giving it to us to put money back in to the economy.. and if people want to go out and buy new computers, furniture, or 700 pizzas and 2000 packs of toilet paper (if they can find it) so be it.