White House Conference on Aging: What You Need to Know First About Enrolling in Medicare

Reading Time: 2 MinutesLast Updated: November 6, 2023

A healthy life is a good life. The Medicare benefits you’ve earned ensure that you can receive the care you need, when you need it.

A healthy life is a good life. The Medicare benefits you’ve earned ensure that you can receive the care you need, when you need it.

And, when it comes to Medicare benefits, the most important thing to remember is to apply for them at age 65.

On your behalf, advocacy groups asked us to place a greater emphasis on information about enrolling in Medicare at age 65, and specifically, about the potential problems that arise if you don’t.

In the past few months, in conjunction with the White House Conference on Aging, the Centers for Medicare & Medicaid Services (CMS) and the Social Security Administration have strengthened many of our communications products to ensure that all people nearing age 65 hear the following message:

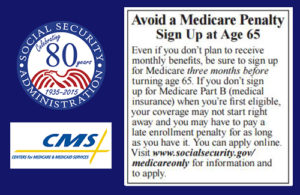

Three months before your 65th birthday, you should apply for Medicare benefits. At that time, you’ll be asked to elect if you also want Medicare Part B that helps pay for doctors’ services and many other medical services and supplies that hospital insurance doesn’t cover. If you don’t sign up at age 65, and you then decide to enroll later, you may pay a lifetime late enrollment penalty, and you may have a gap in medical insurance coverage. There are exceptions, but play it safe, and ask your Medicare or Social Security representative about your personal situation.

To make this message clear, our two agencies have already:

- Updated the text accompanying Medicare cards to emphasize the importance of enrolling in Part B when you’re first eligible, to avoid paying a penalty for as long as you have Medicare coverage.

- Updated publications about Medicare, such as the “Medicare” booklet and the “Apply Online For Medicare In Less Than 10 minutes—Even If You Are Not Ready to Retire” leaflet, to emphasize the importance of enrolling in Medicare when you’re first eligible.

- Updated frequently asked questions on Social Security’s and CMS’ websites, phone scripts, and training materials to better inform those who are newly eligible for Medicare.

- Updated the Social Security Statement and the insert for people who are 55 and older to strengthen the message about when to apply for Medicare. To get your Statement online, open a my Social Security account.

In the next few months, CMS will update their website and the Medicare initial enrollment period package; revise more Medicare publications; and add online resources for people who are still working.

Visit Medicare.gov to find out more about enrolling in Medicare. And, remember to apply online for Medicare three months before your 65th birthday!

Did you find this Information helpful?

About the Author

Comments

Comments are closed.

Charlie

I have medicare and was contacted by my advocate to help me get my medicare payment paid for me. It took a long time for me to get notice I was approved. Now I’m told they will start making my payments next month , will this be retroactive back to when I turned 65 and stared paying medicare?

Ray F.

Hi Charlie, we suggest that you contact your advocate to find out when this change became effective. Thanks!

Steffi

Dec15 captivvating story, and photographs. I like how the writing grounds the specific cultural experience with the larger sonooecocimic realities that gut small towns and contribute to the general deterioration which characterizes this time we inhabit. Siegel has captured the beauty of transcience and decay thoughtfully.

Deborah

I have received SSI since 2012 and in Jan. I turned 62 and it stopped along with my medicaid. Can I be eligible for medicare, since I’ve received the SSI for four straight yrs.?

Ray F.

Thank you for your question Deborah. Medicare is our country’s health insurance program for people age 65 or older.

People younger than age 65 that have been entitled to Social Security disability benefits for 24 months or individuals with permanent kidney failure can also qualify for Medicare. If you’re already getting Social Security benefits, we’ll contact you a few months before you become eligible for Medicare and send you information. Generally, individuals receiving benefits under the Supplemental Security Income or SSI program are only eligible for Medicaid, which is a state-run program that provides hospital and medical coverage for people with low income. For more information, visit http://www.medicare.gov.

Cheryl

I am permanently disabled and have been on SS Disability since the 90’s. I only have Part A, as my husband has wonderful healthcare coverage through his employer that he pays extra for me(covering more than Medicare), and so we have used that. Now with all the healthcare laws changing, laws being incorporated over HSAs, etc. I am now being told most likely he will eventually have to drop me off his insurance because of the HSA and Medicare conflict. How do they expect me to pay for a penalty for Part B going all the way back to the 1990’s?

Ray F.

Thank you for your question Cheryl. You may not have to pay a penalty if you have been covered under your husband’s employer health insurance program. A beneficiary may refuse Medicare Part B, during his or her Initial Enrollment Period, if that beneficiary or the spouse, actively works and has coverage under a group health plan based on that employment, then he or she doesn’t need Medicare part B until the work activity ends or that health care coverage is dropped. To learn more about the Medicare enrollment periods visit http://www.Medicare.gov.

For specific questions about your case, call 1-800-772-1213, M-F between 7 a.m. and 7 p.m. and ask a representative to assist you, or you can contact your local office directly. Hope this helps!

Elaine

Forgot to say. Anything I’ve had done has been completely cov. Between B and supplement

Elaine

Hello,

At 65 I went off my employer’s medical insurance. It had a $5000. yearly Deductible, 20% co-pays, co-pays at doctors. Urgent care was applied to deductible. Had viision. The prescription plan was decent. I was paying $40. Week. Never had a problem with getting scripts or worrying about a gap. I never had enough done for the ins. To pay because deductible always came into play.

I spoke with an agent my mom had for supplemental ins. To Medicare and the decision was best to get off employer ins. And go Medicare A, B, C, and got D. Before I could do this, I had to get a raise to help with the increase in higher cost. It doesn’t cover all of it. Medicare insurance. It’s not cheap!. Now I pay $104.90 for B, about $190 for supplement – Give or take Because I don’t remember exact price. It pays all the Medicare deductibles, and 46.10 for scripts. That all adds up to way more than what I was paying with employer ins.. Scripts are scary. Gap comes into play. D scripts don’t have many tier 1 or 2 on their plans. Scripts can get pretty pricy.

So now, I wonder if I should have stayed with employer ins and paid less, no raise and take chances with high deductible and etc.

Medicare supplement ins and scripts go up almost yearly. Already had increase on scripts.

Sorry to ramble. Sometimes you wonder if the right decision was made.

Robert

Why does TRICARE for Life force me to have and pay for Medicare while living overseas? Medicare does not cover people living overseas and is therefore useless. Again, I am a permanent resident overseas not entitled to a dime of Medicare yet forced by TRICARE to have and pay for Medicare. If I decide not to have Medicare, TRICARE will no longer cover me. ????

Ray F.

Please visit the TRICARE web page for more information, or contact the Department of Defense or a military health benefits advisor for further assistance.

Harlan A.

ggg

Harlan A.

I retired July of 2013, received SS benefits starting Jan of 2014. Wife is retiring Jan, 2016. I am primary under her

health ins but will be secondary after Jan,2016. I have PartA, do I need to sign up for Part B Medicare?

Ray F.

Thanks for your question, Harlan. If you are covered under a group health plan based on your wife’s current employment, you may qualify for a Special Enrollment Period (SEP) that will let you sign up for Medicare Part B. You should always check with your health benefits advisor, or health plan representative to see what’s best for you. For more information call us at 1-800-772-1213, M-F between 7 AM and 7 PM and ask a representative to assist you, or contact your local office. We hope this information helps!

Harlan A.

, do I need to sign up for medicare part B?

Debra

My working husband turned 65 June 2015 and was also diagnosed with slow growing brain cancer. He has no cure or remission recourse. Does he still have to buy into Medicare A or B? He reaches full retirement age at 66. Does he have to be enrolled in Medicare in order to receive his retirement benefits?