Getting Two SSI Payments in One Month

Reading Time: 2 MinutesLast Updated: April 18, 2025

For most months in the year, Supplemental Security Income (SSI) recipients get their SSI payment on the first day of the month. But when the first day of the month falls on the weekend or a Federal holiday, you receive your SSI payment on the last business day before the first day of the month. That means you may get two SSI payments in the same month.

For most months in the year, Supplemental Security Income (SSI) recipients get their SSI payment on the first day of the month. But when the first day of the month falls on the weekend or a Federal holiday, you receive your SSI payment on the last business day before the first day of the month. That means you may get two SSI payments in the same month.

We do this to avoid putting you at a financial disadvantage and make sure that you don’t have to wait beyond the first of the month to get your payment. It does not mean that you are receiving a duplicate payment in the previous month, so you do not need to contact us to report the second payment.

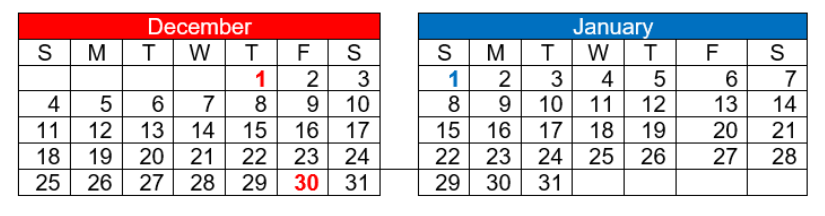

Below is an example of how this will work in January 2023. January 1, 2023 is the Federal holiday of New Year’s Day (it also happens to be a Sunday), so we will not issue your payment on January 1. Since December 31 is a Saturday—and we don’t issue a payment on a weekend—we will issue your SSI payment for the month of January on December 30, 2022. In this example, you get two SSI payments in December.

The first December payment, on December 1, is your regularly scheduled payment for December. The second December payment, on December 30, 2022, is your SSI payment for the month of January. You will not get an SSI payment in January because you received it in December.

On our website, we provide a Schedule of Social Security Benefit Payments for the current and upcoming calendar year.

Securing today and tomorrow starts with being informed. Please share this information with your friends and family—and post it on social media.

Did you find this Information helpful?

Tags: SSI, supplemental security income

See CommentsAbout the Author

Comments

Comments are closed.

Perry R.

Your Social Security calendars for payment schedules are incorrect….they are one year off. Please check these and republish !!

MajJohn

Hardly newsworthy. This happens every December since January 1 is always a holiday. Most financial institutions will make the $$ available to you on the last working day of the month. This applies to SSI, a needs based welfare program and has nothing to do with social security payments.

Denise M.

whatever they call it i don’t care i know i worked for the school board for so many years ,UPS as a second job I deserve some benefits, its not enough to sit home on so most of us citizens who are use to working have to call it that I’m 58 and its not welfare its social security for disabled people…I’ve worked all my life ?? So yo come up with something else to call it …

Tammy

Actually he is correct. Although someone has worked in their life they have to have worked a certain amount of time to receive SSDI. However, if you haven’t reached the work criteria then you would receive SSI. Which also entitles you to be eligible for medicaid and foodstamps which are also welfare.

What’s Considered Welfare?

Any federal or state government program that provides financial or other assistance for housing, food, and healthcare to individuals and families who meet specific guidelines (such as having a low- to moderate-income) is considered welfare.

SSI stands for Supplemental Security Income. Social Security administers this program. They pay monthly benefits to people with limited income and resources who are disabled, blind, or age 65 or older. Blind or disabled children may also get SSI.

There are seven major welfare programs in America, they include:

• Medicaid

• Supplemental Security Income (SSI)

• Supplemental Nutrition Assistance Program (SNAP)

• Child’s Health Insurance Program (CHIP)

• Temporary Assistance to Needy Families

• housing assistance

• Earned Income Tax Credit (EITC)

t

so what who cares what dose that have to do with it ssi you act like it is bad or something

Annamarie

Why are they not taking down that post so upset right now

Tammy

They aren’t taking it down because it is true. He is correct. Although someone has worked in their life they have to have worked a certain amount of time to receive SSDI. However, if you haven’t reached the work criteria then you would receive SSI. Which also entitles you to be eligible for medicaid and foodstamps which are also welfare.

What’s Considered Welfare?

Any federal or state government program that provides financial or other assistance for housing, food, and healthcare to individuals and families who meet specific guidelines (such as having a low- to moderate-income) is considered welfare.

SSI stands for Supplemental Security Income. Social Security administers this program. They pay monthly benefits to people with limited income and resources who are disabled, blind, or age 65 or older. Blind or disabled children may also get SSI.

There are seven major welfare programs in America, they include:

• Medicaid

• Supplemental Security Income (SSI)

• Supplemental Nutrition Assistance Program (SNAP)

• Child’s Health Insurance Program (CHIP)

• Temporary Assistance to Needy Families

• housing assistance

• Earned Income Tax Credit (EITC)

phred

This article is a “beautiful” government spin.

What is NOT told is that if you have automatic deposit to a bank account and if the payment is made on a bank holiday or on a weekend day, you will not have access to those funds until the next official business day.

For example: New Years Day is on a Sunday (1/1/23), it is “officially celebrated” on Monday (1/2/23) as is ANY holiday that falls on a Sunday. Thus you will not be able to access your funds until Tuesday (1/3/23).

Of course even if you have a “live check”, good luck finding someplace that will cash it.

Andie

After your check is direct-deposited, use your debit card to withdraw money to hold you over until after New Year’s. ATM’s are open 24/7.

Tammy

That’s not true. When you receive it through direct deposit it is available to use as soon as it hits your account no matter what the date is.

Also, if you use certain banks you can receive your direct deposit payments even earlier. For example the one I use is called “Chime,” which is through Stride Bank, and I receive my money before the 1st of the month and it is available immediately. I have already received my money allocated for the 1st of January.

Steve S.

Thank you for the heads up. Does this mean that for the tax year 2022, there will be 13 monthly payments in the Adjusted Gross Income (which has an impact on taxes, as well as Medicare deductions)?

Andie

SSI is not taxed!

A.C.

Hi, Steve. This applies to Supplemental Security Income (SSI) beneficiaries only. Also, keep in mind SSI benefits are not taxable. Thanks!

Will J.

I was asked during my phone conference before I got my SSI that had an option of holding as little as 7%, and as much as 22%. Why do you think I was given this information if SSI benefits aren’t taxable? Thank!

John Q.

SSI benefits are not taxable RSDI benefits are possibly. You’ve been calling it the wrong name probably

Ramla N.

Thank you for letting me know but I get my check third week of each month, so it won’t apply to me right.

Loretta C.

My SSI comes third wed will I get the check on December 30

A.C.

Hi, Loretta. Thanks for visiting our blog. This applies to Supplemental Security Income (SSI) beneficiaries only. To see the scheduled payments, you can visit our Schedule of Social Security Payments Calendar. For specific questions, you can call us at 1-800-772-1213, Monday through Friday, between 8:00 a.m. and 7:00 p.m., for assistance. You can also contact your local Social Security office. We hope this helps.

Deborah B.

Thank

Brittney L.

If my husband was incarcerated in December an got out on the 22 will he get his whole check on dec 30

A.C.

Hi, Brittney. Thanks for your question. For information about how prison may affect benefits, please visit our Frequently Asked Questions. For specific questions, your husband can call us at 1-800-772-1213, Monday through Friday, between 8:00 a.m. and 7:00 p.m., for assistance. You can also contact your local Social Security office. We hope this helps.

Patty A.

It is beneficial to all of those where two spouses have worked all their life for SS. Yet, as soon as one spouse dies, there goes the second check. The surviving spouse still is responsible for the bills. We do not get a free pass of our bills being taken care. We know that SS is used for other funding. My impression was that SS funds is to be used for SS. Why do we continue to fund others with living expenses, while you ignore hurting that have to pay for their own expenses. In my opinion bou spouses should received both SS payments until both have passed. Many of us that are use to living on that second check, are suddenly in a state of chaos! Many will have to start receipt food stamps, etc. to survive. Does that make sense? No! How many ex spouses received a check with the ex spouse passes. As far as I know there is not a limit on marriage and then a divorce. Let’s get back to common sense when it comes to two working spouses. I don’t think many people worked their entire life for fun! I know I did not, and my w husband who died did not either. Pls help!

debandtoby

It sounds like you want a free pass.

Phred

Same method applies to pensions from major corporations. Main breadwinner dies, pension ends.

Andie

That’stbe deal… everyone collect ss until they die. Why so u think you are entitled to get your deceased husband’s check??? I’ve been single my entire life; worked full time for 40 years; retired now, living on one ss check and surviving. I have adjusted my lifestyle to living on a limited fixed income! You should make adjustments in your lifestyle; start living within your current means. If your husband’s SS amount was higher than yours, you should get his amount for the rest of your life.

arlene j.

i agree with you, It is a totally new world, when spouse passes away.

Tony

What about all those people whose spouse died before they were able to collect social security. All those surviving spouse only get a $255 death benefits. Their deceased spouses worked their entire life and some paid over a hundred thousand dollars into the social security trust fund but the surviving spouse can only collect $255.

Social Security has treats these people far worse than your current situation.

Kathleen M.

I receive my social security on the 4th Wednesday of each month….this doesn’t apply to me, so I’m confused on why I receive it on that date to begin with…

Asia

Because of your last name

J.G.

You receive social security benefits. They’re talking about supplemental security income benefits. There’s a difference.

MajJohn

The day of delivery is based upon your day of birth, not your name.

Amber

It has to do with ur birthday..

Abraham B.

I get my social security check on the third of each month. This policy you have sent out does not apply to me. About receiving two checks in December. Am I correct?

Vickie T.

Only for “Supplemental Social Security” recipients I believe.

Gladys F.

I reeived my Social Security check on the 2nd Wednesday however my is not SSI but my husband’s 2/3 of Social security benefit. So I get a se3cond check this month? my new e-mail is farrisgladys@gmail.com

Gladys F.

My name is Gladys Farris ***-**-**** born xx-xx-xxxx direct deposit at Farmers Bank & Trust Route Number xxxxxxxxx Saving Account xxxxxxx and a widow my Husband John Farris’s benefit 2/3 Social Security Benefit every 2nd Wednesday of thew month. Will I get a second check?

Cindy P.

Please take this down before someone steals your identity!

Sandra H.

Gladys,

Take your second comment down! Scammers can access your money now with very little trouble!

MajJohn

What’s the matter with you? Don’t post personal information.

Rke

You need to take this down. Delete it. You have given way too much information…

A.C.

Hi, Gladys. This applies to Supplemental Security Income (SSI) beneficiaries only. Just a reminder – please be cautious about posting personal information on social media.Thanks!

DanO

Correct! January 3, 2023 is on a Tuesday.

A.C.

Hi, Abraham. This applies to Supplemental Security Income (SSI) beneficiaries only. Thanks!

Charles B.

Me to I received a $1593 check today Dec 16th. After receiving my reg Dec check SSDI on Dec 2nd.

A.C.

Hi, Charles. Thanks for your comment. For your security, we do not have access to private information in this venue. We ask that members in our Blog community work with our offices with specific questions. You can call us at 1-800-772-1213, Monday through Friday, between 8:00 a.m. and 7:00 p.m., for assistance. You can also contact your local Social Security office. We hope this helps.