Are You Taking Full Advantage of Your Medicare Plan?

Reading Time: 2 MinutesLast Updated: April 18, 2025

Medicare is our country’s health insurance program for people age 65 or older, and for younger people receiving Social Security disability benefits. It helps with the cost of health care, but doesn’t cover all medical expenses or the cost of most long-term care.

Medicare is our country’s health insurance program for people age 65 or older, and for younger people receiving Social Security disability benefits. It helps with the cost of health care, but doesn’t cover all medical expenses or the cost of most long-term care.

You have choices for Medicare:

- Original Medicare includes Medicare Part A (Hospital Insurance) and Part B (Medical Insurance).

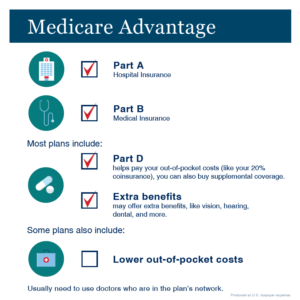

- Medicare Advantage (also known as Part C).

- Medicare Part D (prescription drug coverage).

If you have Original Medicare, the government pays for Medicare benefits when you get them. You can add prescription drug coverage to help pay for costs that Original Medicare doesn’t cover.

Medicare Advantage Plans are offered by private companies approved by Medicare. These “all in one” alternatives to Original Medicare include Part A, Part B, and usually Part D (prescription drug coverage). Medicare Advantage Plans may have lower out-of-pocket costs than Original Medicare. They may also offer extra benefits that Original Medicare doesn’t cover — like vision, hearing, dental, and more.

How you qualify

You can enroll in a Medicare Advantage Plan, if you have Part A and Part B and reside in the plan’s service area. Please be aware there are some restrictions if you have End-Stage Renal Disease. The most common types of plans are:

- Health Maintenance Organization (HMO) Plans.

- Preferred Provider Organization (PPO) Plans.

- Private Fee-for-Service (PFFS) Plans.

- Special Needs Plans (SNPs).

Before you join a Medicare Advantage Plan:

- Find and compare Medicare health plans in your area using Medicare’s Plan Finder.

- Visit the plan’s website to see if you can join online.

- You can also call Medicare at 1-800-MEDICARE (1-800-633-4227). When you call, please have your Medicare number and the date your Part A or Part B coverage started. You can find this information on your Medicare card.

When can I join, switch, or un-enroll in a Medicare Advantage Plan?

- Initial Enrollment Period. When you first become eligible for Medicare, you can join a Medicare Advantage Plan during your Initial Enrollment Period.

- General Enrollment Period. If you have Part A coverage and you get Part B for the first time during the General Enrollment Period, you can also join a Medicare Advantage Plan at that time. Your coverage may not start until July 1.

- Open Enrollment Period. From October 15 – December 7 you can join, switch, or un-enroll in a Medicare Advantage Plan. Your coverage will begin on January 1 (as long as the plan gets your request by December 7).

You can learn more about Medicare, including how to apply for Medicare and get a replacement Medicare card, by reading our publication Medicare. You can also visit our website.

Did you find this Information helpful?

Tags: Medicare

See CommentsAbout the Author

Comments

Comments are closed.

R M.

I currently pay for Medicare because I didn’t work enough quarters to qualify for free Medicare. (I paid into a pension plan instead of Social Security.)

My husband will qualify for free Medicare when he turns 65. Can I qualify for free Medicare then as his spouse?

V.V.

Hi R Mueller, thanks for using our blog. If your husband is fully insured, you could be eligible for Medicare the month your husband attains age 62. To apply for Medicare on your husband’s record, please call your local Social Security office. Please look for the general inquiry telephone number at the Social Security Office Locator. The number may appear under Show Additional Office Information. Please be aware that our call wait times are longer than normal. We hope this information helps.

claudia h.

Hi I am retired from my employer -I am 62 years old I will not apply x medicare o SS now, but my husband turn 65 years old he was covered with my insurance/Empire and my employer told me he need to apply x Medicare, my primary insurance will cover as secondary- but he will need part A,B-is that right or he need to wait until he turn 66 years old, also how can I made appointment at the local Social Security near to me Thank you

A.C.

Hi, Claudia. Thanks for your questions. People 65 or older with coverage under a group health plan from their own or a spouse’s current employment have a special enrollment period. During this “special enrollment period”, they can enroll in Medicare Part B. This means that they may delay enrolling in Medicare Part B without having to wait for a general enrollment period and paying the 10 percent premium surcharge for late enrollment. The rules allow them to enroll under the following two situations:

Enroll in Medicare Part B any time while they have coverage under the group health plan based on current employment; or

Enroll in Medicare Part B during the eight-month period that begins with the month their group health coverage ends, or the month employment ends–whichever comes first.

You will need to complete to submit Form CMS-L564 and Form CMS-40B to your local office. To avoid any lapse in coverage, you should apply at least one month in advance. We hope this helps.

Ram

It is amazingly super medical plan.

Ana M.

My spouse is still working and I have not applied for Social Security payments, yet. I would like to apply for Medicare A&B. I contacted our local SSA office and I was told I needed to complete form CMS-40B and CMS-L564. Both of these forms appear to be for people applying for Medicare B. How about Medicare A? What form do I need to complete?

S.D.

Hi, Ana, and thanks for using our blog. If you are at least 64 years and 9 months old and aren’t receiving Social Security benefits, you can apply for Medicare online, Part A and Part B. It should take less than 10 minutes, and there are no forms to sign and usually no documentation is required. We hope this helps!

Emmanuel S.

All Work No Play Makes Jack a Dull Boy… Spend Time on http://www.247naijabuzz.com

Gary B.

will medicare help with cost of caregiver or a hospital bed and patient hoist

V.V.

Hi Gary, thanks for using our blog. If you need information about Medicare Savings Programs, Medicare Advantage Plans, Medicare Prescription Drug plans, or the covered services, please call 1-800-MEDICARE (TTY 1-877-486-2048) or visit http://www.medicare.gov. We hope this helps.

Alvin c.

How do i get a TPQY form

Janice P.

MUST I have Medicare Insurance deducted from my monthly social security check? I don’t have medical issues, never been to a hospital or doctor other than to have my babies, and I don’t take meds. I have always been very healthy. Can I decide whether or not I want this deducted? Isn’t this like “Socialized Medicine” in a way?

K.T.

Hi, Janice. Thanks for using our blog. If you are receiving Social Security retirement benefits, you will be automatically enrolled in Medicare Hospital Insurance (Part A) and Medical Insurance (Part B) at age 65. However, you may refuse Medicare Part B, during your Initial Enrollment Period, if you or your spouse, actively work and have coverage under a group health plan, based on that employment. Check out our Frequently Asked Questions web page for details on how to refuse Medicare Part B. We always suggest that individuals speak to their personnel office, health benefits advisor, or health plan representative to see what’s best for them, and to prevent any penalties or delayed enrollment in the future. For more information, visit here. We hope this helps!

Tin

Does Medicare have a “special event” clause such as divorce? I’ll have Medicare in April 2021. And at the same time, I’ll be getting divorced. Thank you, Tin

V.V.

Hi Tina, thanks for using our blog to ask your question. Generally, individuals receiving Social Security benefits are automatically enrolled in Medicare Parts A and B. If you are at least 64 years and 9 months old and aren’t receiving Social Security benefits, you can apply for Medicare A and B online.

For details on who can get Medicare, check out our Medicare brochure for the details.

Rahul

Nice blog post, very informative and thanks for upload this.

Blogger at https://techgfworld.com/