Are You Taking Full Advantage of Your Medicare Plan?

Reading Time: 2 MinutesLast Updated: July 19, 2021

Medicare is our country’s health insurance program for people age 65 or older, and for younger people receiving Social Security disability benefits. It helps with the cost of health care, but doesn’t cover all medical expenses or the cost of most long-term care.

Medicare is our country’s health insurance program for people age 65 or older, and for younger people receiving Social Security disability benefits. It helps with the cost of health care, but doesn’t cover all medical expenses or the cost of most long-term care.

You have choices for Medicare:

- Original Medicare includes Medicare Part A (Hospital Insurance) and Part B (Medical Insurance).

- Medicare Advantage (also known as Part C).

- Medicare Part D (prescription drug coverage).

If you have Original Medicare, the government pays for Medicare benefits when you get them. You can add prescription drug coverage to help pay for costs that Original Medicare doesn’t cover.

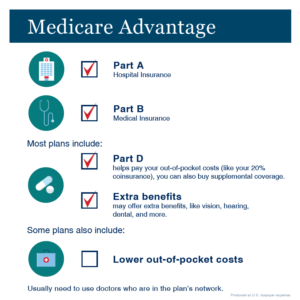

Medicare Advantage Plans are offered by private companies approved by Medicare. These “all in one” alternatives to Original Medicare include Part A, Part B, and usually Part D (prescription drug coverage). Medicare Advantage Plans may have lower out-of-pocket costs than Original Medicare. They may also offer extra benefits that Original Medicare doesn’t cover — like vision, hearing, dental, and more.

How you qualify

You can enroll in a Medicare Advantage Plan, if you have Part A and Part B and reside in the plan’s service area. Please be aware there are some restrictions if you have End-Stage Renal Disease. The most common types of plans are:

- Health Maintenance Organization (HMO) Plans.

- Preferred Provider Organization (PPO) Plans.

- Private Fee-for-Service (PFFS) Plans.

- Special Needs Plans (SNPs).

Before you join a Medicare Advantage Plan:

- Find and compare Medicare health plans in your area using Medicare’s Plan Finder.

- Visit the plan’s website to see if you can join online.

- You can also call Medicare at 1-800-MEDICARE (1-800-633-4227). When you call, please have your Medicare number and the date your Part A or Part B coverage started. You can find this information on your Medicare card.

When can I join, switch, or un-enroll in a Medicare Advantage Plan?

- Initial Enrollment Period. When you first become eligible for Medicare, you can join a Medicare Advantage Plan during your Initial Enrollment Period.

- General Enrollment Period. If you have Part A coverage and you get Part B for the first time during the General Enrollment Period, you can also join a Medicare Advantage Plan at that time. Your coverage may not start until July 1.

- Open Enrollment Period. From October 15 – December 7 you can join, switch, or un-enroll in a Medicare Advantage Plan. Your coverage will begin on January 1 (as long as the plan gets your request by December 7).

You can learn more about Medicare, including how to apply for Medicare and get a replacement Medicare card, by reading our publication Medicare. You can also visit our website.

Did you find this Information helpful?

Tags: Medicare

See CommentsAbout the Author

Comments

Comments are closed.

Assia w.

Our Medicare Leads are legit and will several prospects for your business. We have a huge workforce of over 300 agents working day and night producing hundreds of leads every day. If you in search of a big turn around in the least amount of time, then we are here to assist you.

Visit our website: https://starleadsmedia.com/medicare-leads/