White House Conference on Aging: What You Need to Know First About Enrolling in Medicare

Reading Time: 2 MinutesLast Updated: November 6, 2023

A healthy life is a good life. The Medicare benefits you’ve earned ensure that you can receive the care you need, when you need it.

A healthy life is a good life. The Medicare benefits you’ve earned ensure that you can receive the care you need, when you need it.

And, when it comes to Medicare benefits, the most important thing to remember is to apply for them at age 65.

On your behalf, advocacy groups asked us to place a greater emphasis on information about enrolling in Medicare at age 65, and specifically, about the potential problems that arise if you don’t.

In the past few months, in conjunction with the White House Conference on Aging, the Centers for Medicare & Medicaid Services (CMS) and the Social Security Administration have strengthened many of our communications products to ensure that all people nearing age 65 hear the following message:

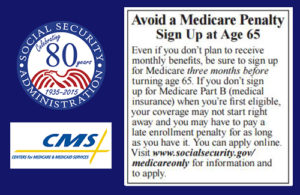

Three months before your 65th birthday, you should apply for Medicare benefits. At that time, you’ll be asked to elect if you also want Medicare Part B that helps pay for doctors’ services and many other medical services and supplies that hospital insurance doesn’t cover. If you don’t sign up at age 65, and you then decide to enroll later, you may pay a lifetime late enrollment penalty, and you may have a gap in medical insurance coverage. There are exceptions, but play it safe, and ask your Medicare or Social Security representative about your personal situation.

To make this message clear, our two agencies have already:

- Updated the text accompanying Medicare cards to emphasize the importance of enrolling in Part B when you’re first eligible, to avoid paying a penalty for as long as you have Medicare coverage.

- Updated publications about Medicare, such as the “Medicare” booklet and the “Apply Online For Medicare In Less Than 10 minutes—Even If You Are Not Ready to Retire” leaflet, to emphasize the importance of enrolling in Medicare when you’re first eligible.

- Updated frequently asked questions on Social Security’s and CMS’ websites, phone scripts, and training materials to better inform those who are newly eligible for Medicare.

- Updated the Social Security Statement and the insert for people who are 55 and older to strengthen the message about when to apply for Medicare. To get your Statement online, open a my Social Security account.

In the next few months, CMS will update their website and the Medicare initial enrollment period package; revise more Medicare publications; and add online resources for people who are still working.

Visit Medicare.gov to find out more about enrolling in Medicare. And, remember to apply online for Medicare three months before your 65th birthday!

Did you find this Information helpful?

About the Author

Comments

Comments are closed.

Daniel K.

I am 61 yrs old and have Social Security Disability. At what year will my account be changed to regular Social Security? And will my monthly check change in the amount that I regularly get now?

Deborah S.

Most likely your retirement age for regular Social Security is 66 yrs. Your SSA statement specifies your retirement age and your disability will change to regular then and no your monthly amount will not change. Please visit http://www.ssa.gov and you can get all the specific answers to your questions and most of all, open an online account to view your statements, etc..

Lorenzo D.

Thanks for your question, Daniel. When you reach full retirement age, we will automatically convert your disability benefits to retirement benefits, but the amount remains the same.

Sandra

I have been on the state ship program for few years now. And my extra carrier I could never get in to see the doctor. That I needed to see specialist. The last year they sent me an ahccess card which I figured it was Medicare ahccess program. Just said to use this card. So I have see a specalist. Did some GI procedures.

Stanley J.

Why is Medicare not available to USA citizens living in Europe? I chose Part A but not Part B because its not applicable in Italy. And why must I pay an enormous fee if I decide to take Part B when I return to the states.

I feel it would be fair if there was an exemption from the retroactive fee for people living abroad who later return to the states.

John

You are correct! They haven’t answered me either!

James L.

Hi Stanley — sorry for the delay in providing a response to your questions. We researched this issue extensively to give you answers and provide information for others in the same situation.

Medicare is a health insurance program based on residence in the U.S. and its territories, although certain exceptions apply to Medicare Coverage Outside the United States. All beneficiaries who enroll in Part B must pay a premium, regardless of where they live. Many Social Security beneficiaries who live abroad choose to enroll in Part B during their Initial Enrollment Period (IEP) at age 65, knowing they’d be paying premiums for coverage they cannot take advantage of, because they plan on moving back to the United States, or come here frequently. However, if you’re a U.S. citizen living in a foreign country, over age 65, and NOT eligible for Social Security benefits, you won’t have to pay a higher premium if you enroll in Part B within 3 months of your return to the U.S.

Unfortunately, there is no exemption to the surcharge if you do not enroll during your IEP, unless you have proof that you’ve been working and covered by a current employer and qualify for the Special Enrollment Period (SEP). You will have a chance to enroll in Medicare Part B during the General Enrollment Period (GEP), which occurs every year from January 1 through March 31, and yes, a late enrollment penalty may apply. For more information about enrollment periods see our publication Medicare.

Remember to contact your local U.S. embassy for any assistance or other specific questions in regards to your Social Security benefits.

John

When will the people residing overseas be able to get reimbursed for their medical expenses under Part B? I’m paying for part B right now and it gives me no benefit overseas. When will the law be changed! It’s very unfair to us expats! I can only use it in the USA. I hope the next president will do something about this situation!

James L.

Hi John. Many Social Security beneficiaries who live abroad choose to enroll in Part B during their Initial Enrollment Period (IEP) at age 65, knowing they’d be paying premiums for coverage they cannot take advantage of, because they plan on moving back to the United States, or come here frequently. All beneficiaries who enroll in Part B must pay a premium, regardless of where they live. If you wish to terminate your Medicare Part B enrollment, a signed request for termination and a personal interview are required. You will need to contact your local embassy or consulate for assistance and to discuss your options.

Celina

Olá, Olga. Foi o último post que esesovcmer, mas o blog não morreu. heheEstamos apenas esperando que o programador entregue o layout novo para poder voltar a postar. Fique de olho! 😉

JOHN

If I had known what I know now… I would of gotten the part B when I turned 65 … but like a fool I didn’t think I would need it. Now I am 69 yrs of age… came down with Cancer… I put in for the Part B and found out that I will be paying $165.oo for the rest of my life every month from now on…so please don’t be a fool like me’ read up on this and do it the right way from day one’…

Bob

Be aware, the Part B penalty is 10% for each 12 month period without Part B. If Part B premium rises, the penalty amount will also rise to reflect the percentage. Part D penalty is 1% for each month based on the yearly benchmark.

Reed

You should have enrolled at age 65. You may be subject to penalties. See http://www.medicare.gov/your-medicare-costs/part-b-costs/penalty/part-b-late-enrollment-penalty.html

Otherwise Part A can be no cost if eligible. Part B cost is dependent on income level. Part D varies by plan selected. Read details at http://www.medicare.gov/your-medicare-costs/part-b-costs/part-b-costs.html and

http://www.medicare.gov/part-d/costs/part-d-costs.html

Darlene M.

i will be 65 in December. I went to the Social Security office in June. They informed me that SSA has a new process of sending out the Medicare card. What should I do? I have TRICARE as my insurance and I don want to lose that.

Susanne

Do you have Tricare for life?

MJones

Contact the local SHIP office in your state.

https://www.shiptacenter.org/

Ed

When you apply for Medicare, make sure you apply for Part B. If you don’t do this you will not qualify for Tricare for life.

Dale

I had Medicare and Tricare for Life is my supplemental insurance. They pay what Medicare doesn’t. Plus T for L pays for drugs so I don’t need Part D.

Really great IMHO.

Esther

What’s T for L that pays for drugs

Billie

T for L is Tricare for Life. This is the Military RETIREMENT Health Insurance. Even though medical care was supposed to be free for life (big selling point upon joining), the military now has to pay for the Part B coverage like anyone else in order to keep the Tricare for Life Coverage. T for L then picks upon most medical co-pays and gives Part D coverage – there is still a copay for all non-generic drugs. There is a recent trial program where generic drugs are free if you do mail order, but I expect that will not last. Co-pay for all drugs from local providers.

Lorenzo D.

Darlene, if you are already getting Social Security retirement benefits, you will be enrolled in Medicare Parts A and B automatically, and you should receive your card in the mail no later than a couple of weeks prior to the month you turn 65. You can create a my Social Security account to take advantage of the “new process” that allows beneficiaries to obtain immediate proof of Medicare coverage, or order a replacement Medicare card online. If you have coverage under a program from the Department of Defense, your health benefits may change or end when you become eligible for Medicare, so please contact TRICARE or a military health benefits advisor for more information. To learn more about Medicare, and for more information on how other health insurance plans work with Medicare, go to http://www.medicare.gov.

Roseanna

Hi Naomi, If you add liquid to the shells they will not work (even 1 teaspoon is too much) they will turn out lumpy and flat. Most people make rose water ganache – a white chocolate ganache with rosewater mixed in – as a flavoured filling. Try 200g white chceolato, heat up 100g cream and pour over the chocolate, leave for a couple of minutes and then stir until smooth. Stir in you rosewater to taste.

Jim M.

Thank you this is appreciated.

Lorna H.

My husband and I are still fully employed, have registered for Medicare A, but are covered by his work policy. What do we need to do to comply as described in your message above?

Lorna Horishny

George Horishny

MJones

Contact the local SHIP office in your state.

https://www.shiptacenter.org/

Lorenzo D.

Greetings Lorna and George! Since you are both covered under a group health plan based on employment, you don’t need Medicare part B until the employment ends or you drop your health care coverage. However, you should speak to your personnel office, health benefits advisor, or health plan to see what’s best for you. For more information, please see how to sign up for Medicare Part B.

Khalil A.

I’m over 66 I’ll be 67 in December, I have not applied for social security benefit yet, I’ll be applying before the end of the year. What are the costs involved as far as my Medicare ?

Susanne

I pay $107.00 per month, this is not a choice!

Betty

I receive Medicare through my husband’s Social Security investment over his lifetime of working. (Being a teacher in Texas means we are affected by the GPO, Government Pension Offset, meaning that if we apply for any SS, our teacher retirement pension is offset by what we receive from SS). Thanks goodness, I have been able to subscribe to Medicare through my husband’s SS. I have authorized a bank withdrawal by Medicare for my premium of $104.90. Husband’s Medicare premium is deducted before his monthly SS check is deposited.

Betty

Note: We have Parts A and B, and we signed up for Medicare the year we became 65 (We are the same age — 2 months difference.)

Christine

I am also to be penalized by the Windfall calculation. So, are you simply postponing receiving SS, or have you found a way around this unfair practice?

MJones

Contact the local SHIP office in your state.

https://www.shiptacenter.org/

Spike

Way to use the internet to help people solve prmbseol!

Lorenzo D.

Hi Khalil, and thank you for your question. You do not have to pay a premium for Medicare Part A (Hospital Insurance) if you worked long enough in jobs where you paid taxes for Social Security and Medicare. The standard Medicare Part B (Medical Insurance) monthly premium for 2015 is $104.90. Higher income beneficiaries pay more.

If you have not applied for Medicare, you should do so as soon as possible, even if you are not ready to start receiving retirement benefits yet. If you are still working and covered under a group health plan based on your employment, you can decline Medicare Part B until you stop working or drop your health care coverage.

For more information, please read our publication, “Apply Online for Medicare in Less Than 10 Minutes – Even If You Are Not Ready to Retire”.

Rick

Please check with your employer BEFORE you file for Medicare at age 65. Following the info in this thread I discovered that I must terminate contributions to my health care spending account. Both me and my employer must withdraw any $$ contributed after my birthday. My employer suggested that I withdraw from Medicare to reinstate the HSA. A lot of time wasted over incorrect advise

Ray F.

We appreciate your comment Rick, and we agree! That’s our advice to individuals nearing age 65 who plan to continue to work — to speak to their personnel office, health benefits advisor, or health plan representative prior to enrolling in the Medicare program, to find out what’s best for them.

Michaelene

I am in the same quandary and have been trying to get OFF Medicare for 10 months. The Social Security office says it will happen but it has not. Any suggestions?

Ray F.

Hi Michaelene. If you are talking about your Medicare Part B, our policy requires a personal interview be conducted with everyone who wants to terminate their Medicare Part B benefits. Representatives at your local Social Security office will help you submit the required Form CMS-1763, “Request for Termination of Premium Hospital and /or Supplementary Medical Insurance”, or your signed request for termination, but we need to speak to you personally before we terminate your Medicare benefits to be sure that you fully understand the consequences of doing so. We do not offer Form CMS-1763 online. If you’ve already had this personal interview, please continue to stay in touch with your local office or call us at our toll free number, 1-800-772-1213 (TTY 1-800-325-0778) to keep track of the status of your request.

In most cases, you can only request disenrollment or changes to your Medicare Part C & D during the Annual Enrollment Periods, and would need to contact Medicare directly at 1-800-633-4227. Or, you can also contact your Medicare plan provider for more information.