See What You Can Do Online!

Reading Time: 1 MinuteLast Updated: August 19, 2021

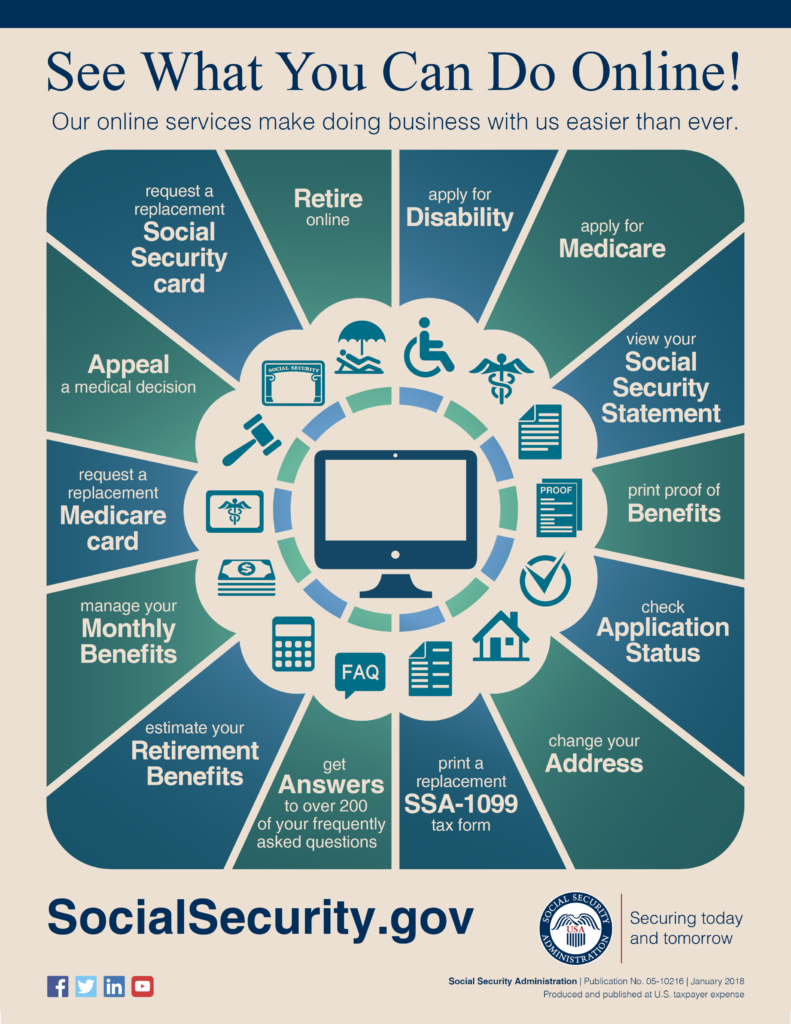

For over 80 years, Social Security has changed to meet the needs of our customers. Today, our easy, secure, and convenient-to-use online services allow you to do business with us from the comfort of your preferred location. From requesting a Social Security card to filing for retirement, our online services have got you covered. Check out our infographic, which shows what you can do online:

Did you find this Information helpful?

Tags: retirement benefits, Social Security benefits

See CommentsAbout the Author

Comments

Comments are closed.

Fanisha N.

I am a widow who has been married for over 10 years and are now a widow my husband was on SSD at time of death do I qualify for benefits?

Vonda

Hi Fanisha, thanks for using our blog to ask your question. You may be eligible for reduced widows benefits as early as age 60 (age 50 if disabled) and at any age if caring for the deceased’s child who is under age 16 or disabled and receiving benefits on the deceased’s record. Survivor benefit amounts are based on your husband’s earnings. The more he paid into Social Security, the higher the benefits would be. The benefits will not be established automatically, you will have to contact us. You can call your local Social Security office. Look for the general inquiry telephone number at the Social Security Office Locator. The number may appear under Show Additional Office Information. Please be aware that our call wait times are longer than normal.

Check out our If You Are The Survivor web page for details. We hope this helps!

william p.

I am 60 years old, been incarcerated a majority of that time making me not earning enough credits for S.S. My question is How much will I get each month and starting at what age? Based on what I have just said.

Vonda

Hi William, thanks for using our blog. To get SSI, you must be disabled, blind, or at least 65 years old and have “limited” income and resources. Check out our Understanding SSI web page for details.

If you have additional questions, you can call us at 1-800-772-1213 for assistance or you can contact your local Social Security office. Please look for the general inquiry telephone number at the Social Security Office Locator . The number may appear under Show Additional Office Information. Please be aware that our call wait times are longer than normal. We hope this information helps.

Sonja

all I would like to do is put a “change of address” in. Why do I need to open an account?

Vonda

Hi Sonja, thanks for using our blog. Check out our Frequently Asked Questions web page for details on how to change your address. We hope this is helpful!

John A.

My Aunt is 93 years old and has suffered strokes in the last several years. She is home bound and unable to converse. She did not receive her 2020 social security tax statement and I would like to know how to request another for her. I am her designated Power of Attorney and am trying to arrange for her income taxes to be prepared. Please let me know what to do to get another statement mailed to her residence.

Linda G.

I never received my 600 stimulus payment. I have direct deposit and have my checks automatically deposited each month and I dont need to file my annual taxes. Others who are on ss disability or ss and do not file taxes have received their 600. Will I still get mine?

Vonda

Hi Linda, thanks for using our blog. The Internal Revenue Service (IRS), not Social Security, issues the Economic Income Payments. Social Security cannot answer EIP questions about your specific situation. Check out our Social Security and Coronavirus web page for more details. We hope this helps.

ROSS B.

my wife has died how do I receive additional benefits

Ines

Ola, recebe sempre pelo Banco e este recebi um cheque e também um comunicado informando que não pode mais receber por cheques. Entre no site para tentar fazer meu cadastro para a conta, porém não consegui porque não tenho conta nos EUA, somente em outro país. Como devo proceder?

Ines

Ola, recebe sempre pelo Banco e este mês recebi um cheque e também um comunicado informando que não poderá mais receber por cheques. Entrei no site para tentar fazer meu cadastro para a conta, porém não consegui porque não tenho conta nos EUA, somente em outro país. Como devo proceder?

Ann C.

Hi, Ines. For information in Spanish, please visit us at http://www.segurosocial.gov, http://www.facebook.com/segurosocial, or http://www.twitter/segurosocial. For Social Security information in other languages, please visit us at http://www.socialsecurity.gov/multilanguage. Thanks!

peter c.

How do I change the amount being withheld from my check

peter c.

how do I change the amount being with held from my check

peter c.

how do I change the amount being withheld from my check

Vonda

Thank you for your question, Peter. To change your federal tax withholding, you will need to complete Form W-4V. You can download the form or call the IRS toll-free at 1-800-829-3676 and ask for Form W-4V. Mail the completed, signed form to your local Social Security office. Use our Social Security Office Locator to obtain their mailing address.

Check out our Withholding Income Tax From Your Social Security Benefits web page for more information. We hope this is helpful!